While many of my intermediate and long term technical indicators are starting to line up, indicating that it may be prudent to start selling now, I am not seeing the bearish trigger yet. To review, let's consider the charts from the three major regions of the world, US, Europe and China.

What does defensive leadership mean?

In the US, the stock market remains in an uptrend. The SPX, as shown below, remains in an uptrend and it is above both its 50 and 200 day moving average. For traders, it may be premature to get overly bearish without some catalyst or trigger.

The warning signs are there. Defensive sectors have been leading the market. Analysis from Thomson-Reuters shows that the defensive sectors have fared the best in the May-October period during the 21st Century. Is the market is anticipating a downturn or correction?

Consider the chart below of the relative performance of Utilities against the market. The sector appears to be making a saucer shaped relative bottom, which is an indication that the intermediate term outlook for relative performance is positive.

Similarly, look at the relative performance of Consumer Staples. The sector staged a relative upside breakout in late March and remains in a relative uptrend, though it got over-extended and pulled back last week.

As well, take a look at the relative performance chart of Healthcare. Like Consumer Staples, this sector staged a relative upside breakout in March and has also pulled back recently, though the relative breakout remains intact.

Meanwhile, cyclical stocks appear to be rolling over against the market. The chart below of the Morgan Stanley Cyclical Index against the market shows CYC to be failing at a relative resistance level and starting to roll over in relative performance.

The defensive vs. cyclical theme has also played out in the real estate sector. Consider the relative performance of the cyclically oriented homebuilding group, which was on a tear for all of last year, but it is now consolidating sideways after violating a relative uptrend.

By contrast, the chart below of the relative performance of the more defensively and yield oriented REITs against the market shows that this group staged a relative upside breakout in early April, pulled back but the relative breakout remains intact.

Premature to go short

Is it time to get bearish and get short the market? Not yet. I consider the US market to be at a crossroad. The rally last week was led by an oversold bounce in gold and other resource sectors. As the chart below shows, gold has rallied to mostly fill the gap from its recent freefall. We now need to watch if there is any follow through or if gold (and the stock market/risk-on trade) can continue upwards from here.

Another bearish setup has been the relative performance of stocks to Treasuries. As the relative performance chart below shows, stocks remain in a minor relative downtrend to bonds after breaking down from a recent relative uptrend.

In addition, the longer term chart of the 10-year yield shows that bond yields remain in a downtrend and the recent uptick looks like a flag pattern, which is a continuation pattern indicating that bond yields are likely to fall further. As well, David Rosenberg (via Pragmatic Capitalism) indicated that recent sentiment polls showed that there were virtually no bond bulls around. If bond yields fall (and bonds therefore rally), it would likely be bearish for stocks.

However, stocks continue to grind upward because of its fundamental underpinnings of positive earnings momentum. Earnings Season is coming roughly in line with historical experience. Thomson-Reuters reports that with about 20% of the SPX companies reporting, 67% of the companies have beaten earnings expectations, which is in line with the historical experience, but only 44% have beaten on revnues. Nevertheless, Ed Yardeni pointed out that forward earnings estimates are still rising - which should support the bullish impulse in stocks.

To get more bearish on US equities, I would like to see some combination of:

- Earnings getting revised downwards, or more misses in earnings reports;

- More misses in the high frequency economic releases, e.g. New Deal Democrat pointed out that much of the miss in last Friday's GDP report was attributable to a fall in government spending;

- Major averages to decline below their 50 dma; and

- Failure of cyclical sectors to regain their leadership and defensive sectors to outperform.

Europe: Waiting for the ECB?

Moving across the Atlantic, the pattern of the European bourses bear an uncanny resemblance to the American one. Despite the well publicized problems in the eurozone, European stocks remain in an uptrend. The chart below of the STOXX 600 shows the index to be above its 50 and 200 day moving averages, though there is some work for the bulls to do as the index is approaching overhead resistance.

As well, I pointed out last week (see Commodity weakness is likely localized) that peripheral country markets were outperforming the core European markets even as stocks declined. This is evidence of rising risk appetites in Europe.

It appears that the market is expecting further stimulus from the European Central Bank this week. Recent economic releases have been so weak, so bad that they're good. Conditions have weakened to the extent that the ECB may be forced to take further action to stimulate the eurozone economies. As Benn Steill and Dinah Walker of the Council on Foreign Relations pointed out, a rate cut is not necessarily a done deal as it may run counter to the ECB's price stability mandate:

In those Eurozone countries where the monetary transmission mechanism is still working normally—Austria, Finland, France, Germany, and the Netherlands—the GDP-weighted-average inflation rate is 1.8%, right near the ECB’s target. France, with 1.1% inflation and 10.8% unemployment, would appear a strong candidate for a rate cut, but not the others. Germany has 1.8% inflation and only 5.4% unemployment. The other three all have above-target inflation rates: Austria at 2.4%, Finland 2.5%, and the Netherlands 3.2%. Austrian unemployment is low, at 4.8%. Dutch unemployment is a moderate 6.4% Only Finnish unemployment is high, at 8.2%.In Europe, my bearish triggers are a combination of watching for:

Some will argue that a bout of robust inflation in the north is just what is needed to restore competitiveness in the south. But the ECB will have to willfully ignore its price-stability mandate if it is to justify a rate cut right now, and it will almost certainly need to apply more radical tools if it is to aid the south quickly. “The ECB is obviously in a difficult position,” German Chancellor Angela Merkel said on April 25. “For Germany, it would actually have to raise rates slightly at the moment, but for other countries it would have to do even more for more liquidity to be made available and especially for liquidity to reach corporate financing.”

- Peripheral market underperformance

- A possible negative reaction to ECB action. Assuming that there is a rate cut, could the market buying the rumor and selling the news?

China: Markets shrugging off weakness

In China, most of the recent economic releases have been below Street expectations. What's more worrying are indications that the new leadership is more concerned about financial system stabililty than growth (via Kate Mackenzie of FT Alphaville):

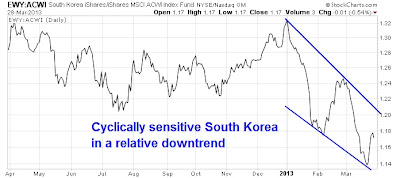

The official Xinhua report is here and its headline suggests some worry at the economic growth rate. “China needs to cement its domestic economic growth momentum and guard against potential risks in financial sectors,” seems to be the key line, from the third paragraph, although it goes on to point out that Q1′s 7.7 per cent growth that had many China watchers worried was in fact higher than the 7.5 per cent official target.Translation: Don't expect more stimulus measures if the economy slows further. Despite these concerns, the markets have shrugged off signs of Chinese weakness. A good measure is the relative performance of the Australian stock market (EWA) to MSCI All-Country World Index (ACWI) as most of Australia's raw material exports go to China. EWA remains in a relative uptrend against ACWI, though there was a recent minor violation of the relative uptrend:

Then there’s this:

While focusing on improving the quality and efficiency of economic development, the country should keep a proactive fiscal policy and prudent monetary policy while making them more targeted, it said.Hmm… more targeted…

Bloomberg’s take is here and they’ve also noted that the official statement focused on risks despite the slowdown; they also point out the emphasis on boosting the consumption (ie, rebalancing the economy; which as we’ve outlined before, can’t really happen unless growth slows).

Another key indicator that I have been watching is the AUDCAD currency cross. Both Australia and Canada are resource-based economies, but Australia is more sensitive to Chinese growth while Canada is more sensitive to American growth. The AUDCAD violated an uptrend that began last October on Friday, but I would like to see some further weakness to confirm that this trend violation is not a minor one as we saw in the above chart of EWA against ACWI.

Investor or trader?

Let's go back to the original question, is it time to sell in May?

My inner investor thinks that it may be prudent to trim back some equity holdings, but my inner trader says, "Not yet." He is still waiting for a bearish trigger. I became a reluctant bull in late March (see An uncomfortable bull). Even though my Trend Model turned neutral briefly two weeks ago, it flipped back to risk-on last week and I am still inclined to give the bull case the benefit of the doubt - for now.

My inner trader is still waiting for the aforementioned bearish triggers before getting more defensive.

Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.