The full post can be found here.

Wednesday, April 2, 2025

Here's what's more important than the tariff announcement

Mid-week market update: The market approached Trump's "Liberation Day" tariff announcement all beared up. Trading desk surveys indicate that most retail and institutional market participants had reduced risk coming into the announcement, with outright bears outnumbering the buy-the-dip crowd by 7%.

While the ultimate outcome of the Trump tariffs will move markets, there's something even more important than the announcement.

Labels:

economy,

sentiment analysis,

Technical analysis,

Trade policy

Monday, March 31, 2025

It's time to hang them up (or the long goodbye)

Special Announcement: Humble Student of the Markets will cease publishing a year from now, on March 31, 2026. (This is being published on March 31, 2025 and it is not an April Fools joke).

Here's some history. I began writing Humble Student of the Markets in 2007. I had left Merrill Lynch to begin my semi-retirement after starting an investment career in 1985, and personally involved in the stock market since 1980. At the time, I made a decision to slow down and spend more time with my family. In the intervening years, I saw my daughter grow up from a child to a young woman. I was fortunate that life offers such a trade-offs, and I don't regret a minute of that decision.

But I was restless and I still had a passion for the markets. So I started blogging in 2007, and writing regularly was a way of expressing my investment process on paper. It was a labour of love. The blog gained a following and eventually turned into a pay-site in 2015. After 17 years of writing, the labour of love has turned into a grind of producing content three times a week. The game is changing and I am running out of things to say.

I have seen two major shifts of investing paradigm during my investing career. In the early 2000s, I changed my focus from a bottom-up to a top-down quantitative equity investor. By that time, the barriers to entry to bottom-up quant investing had dropped dramatically. When once quant managers had to devote resources to integrate and manage their own databases, services like FactSet offered an all-in-one integrated database. Quant managers were crowding into the same trade. Virtually everyone were building bottom-up sector or industry neutral stock picking models. While your industry mapping may be different from mine, and our estimate revision models may differ, we were all crowding into the same trade. When it cost millions a year of data support to become an equity quant, you could build a quant department for under 500K. I decided that it was time to shift to something uncomfortable for equity quantitative investing. Instead of trying to find alpha in sector/industry neutral modeling, it was time to add value by rotating among top-down factors such as market timing, and sector and factor rotation.

Today, the game is changing once more. A recent Bloomberg article entitled "How Analyst Job Cuts on Wall Street Are Shaping Equity Research" tells the story of how investment banks are forcing analysts to do more with less. Consequently, company coverage is shrinking and some analysts have quit to become content creators on platforms like Substack. This will have the effect of raising stock picking alpha potential among smaller neglected names, and raising small cap volatility, both on an index and individual stock level. The degree of value-added in top-down analysis like what I offer is gradually losing to bottom-up approaches.

From a top-down perspective, see my recent post, "Uncharted investor waters: From soft to hard power". This is truly a time when "past performance is no guarantee of future returns". We are on the cusp of a tectonic shift in asset return expectations with unknown consequences.

As old athletes might say, "It's time to hang them up."

Here is what this means for the site going forward.

For existing subscribers

If you are an existing monthly subscriber, nothing will change until March 31, 2026. If you are an annual subscriber, your subscription will be pro-rated on a monthly basis to March 31, 2026.

For new subscribers

Only monthly subscriptions will be available. Annual subscriptions will cease.

For free notifications

I have a long standing policy of opening content that's four weeks old to the public. That policy will not change. You could sign up for free email notifications of free content.

Going forward, free email notifications will cease operation immediately, but the embargo on content will continue to lift after four weeks.

Legacy plans

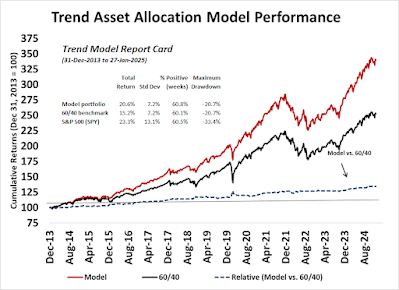

I have secured an agreement with Fred Meissner, of The Fred Report, to continue publishing a monthly commentary on my Trend Asset Allocation Model at his site. Fred is an experienced ex-Merrill Lynch colleague and seasoned technical analyst who focuses on global markets with a particular emphasis on the U.S.. Existing subscribers will receive a free trial to Fred's service for three months starting January 1, 2026.

You can also sign up for a subscription today at Fred Meissner's site and receive a discounted rate with the code CamTrial. His basic subscription is written service listed at $40/month or $400/year. His premium subscription includes the written service and a weekly conference call where subscribers can ask specific questions is $100/month or $1000/year.

The website, its archived content, and my email address will remain

in existence for at least a year.

For subscribers who are focused on macro style market commentary, here are some other people whose analysis that I have a lot of respect for that you may consider following. (I receive no compensation for these recommendations).

Jim Paulsen, Paulsen Perspectives Substack: Veteran Wall Street strategist with unique out-of-the box insights.

Callum Thomas, Topdown Charts: A big picture macro thinker whose investment process aligns with mine.

Jurrien Timmer, director of macro at Fidelity: You can follow him on X/Twitter here. He also has a weekly newsletter that you can sign up for on LinkedIn.Thank you for your past support

Thank you to all. It's been a terrific journey together. This will be a long goodbye, but I think a

lot about Bill Watterson, the cartoonist who published Calvin &

Hobbs, who quit after he ran out of things to say. This was his final

comic strip on December 31, 2015.

Sunday, March 30, 2025

The message from gold's generational breakout

Preface: Explaining our market timing models

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 28-Feb-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Generational Breakout

In case you missed it, the price of gold staged a generational upside breakout relative to both the S&P 500 and the 60/40 balanced fund, as measured by Vanguard’s VBINX (bottom two panels). On an absolute perspective, gold already broke out of a cup and handle pattern at 2100, indicating significant upsid0e potential. From a cross-asset perspective, past breakouts have coincided with periods of severe financial stress.The full post can be found here.

Labels:

asset allocation,

energy,

gold

Saturday, March 29, 2025

Uncharted investor waters: From soft to hard power

Markets were rattled by policy under Trump 1.0 by his unpredictable and chaotic nature. Trump 2.0 promises to be more of the same. Other than the transactional nature of Trump’s deal making, what’s his ultimate end game?

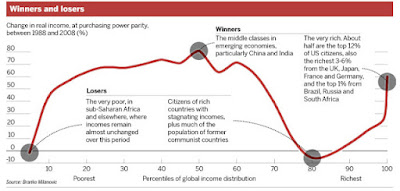

It’s to undo the effects of globalization. The political backdrop can be explained by Branko Milanovic’s famous “elephant chart”. The graph charts percentile of global income distribution, or how rich you are on a global scale, on the x-axis, and the changes in real income between 1998 and 2008 on the y-axis. The winners of globalization were the emerging market countries whose population were lifted out of poverty and the elite of the industrialization countries, who engineered globalization. The losers were population in subsistence economies and the middle class of the industrialized countries, which has sparked populist backlashes such as the Make America Great Again movement, the AfD in Germany, the National Front in France, and so on.

Trump rose to power by tapping on the deep political discontent of globalization of MAGA Americans. Here’s what this means for investors.

The full post can be found here.

Labels:

Economics,

investment policy,

Trade policy

Wednesday, March 26, 2025

A change in market tone

Mid-week market update: The stock market's relief rally arrived this week when the WSJ reported over the weekend that Trump's "Liberation Day" reciprocal tariffs due to be announced on April 2 will be narrowly focused. The S&P 500 rallied to regain its 200 dma. The index pulled back below the 200 dma when Bloomberg reported that "Trump Prepares Auto Tariff Announcement as Soon as Wednesday", though the upside price gap from Monday remains unfilled.

Despite today's downside reversal, recent trends are emerging that indicate a change in the tone of price action.

Labels:

Technical analysis

Sunday, March 23, 2025

How to trade the momentum reversal

Preface: Explaining our market timing models

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

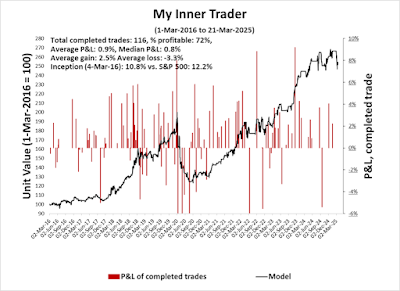

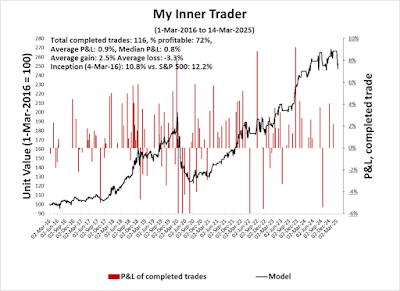

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 28-Feb-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Risk-off Reversal

The most recent BoA Global Fund Manager Survey revealed a sudden reversal in risk appetite. Global institutional investors stampeded out of risky assets and rotated from U.S. equities into Europe and China. Most of the selling was concentrated in the U.S. Magnificent Seven, which had been the market leaders. It was a stunning display of a reversal in price momentum.

The full post can be found here.

Labels:

sentiment analysis,

Technical analysis,

Trend Model

Saturday, March 22, 2025

Making sense of market uncertainty

The latest FOMC statement and subsequent press conference were full of references to “uncertainty”. Most notably, the FOMC statement changed the language related to the Fed’s goals being “roughly in balance” to “uncertainty around the economic outlook has increased”.

Not only is uncertainty elevated, but also the risks to inflation, GDP growth and employment have risen in 2025, which increases the odds of stagflation ahead.

How should investors react to the increase in policy uncertainty?

Labels:

economy,

federal reserve

Wednesday, March 19, 2025

Who's left to sell?

Mid-week market update: Four weeks ago, I rhetorically asked in a post, "Who's Left to Buy?" The BoA monthly Global Fund Manager Survey had shown cash levels at a 15-year low. In addition, a Schwab survey of customer accounts showed cash at similarly historical lows. It was the case of an accident waiting to happen.

So the accident did happen as the S&P 500 fell -10% in about three weeks. This month, the Fund Manager Survey showed the sharpest sentiment reversal in five years.

Sunday, March 16, 2025

Why the market won't crash from here

Preface: Explaining our market timing models

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 28-Feb-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Confirmed 5% Canary Warning

The S&P 500 flashed an Andrew Thrasher 5% Confirmed Canary warning last week, which is defined as “the underlying index declines 5% within 15 days from its 52-week high, and closes under 200 dma for two consecutive days”. The signal is based on a research paper that won the 2023 Charles Dow Award.If history is any guide, subsequent drawdowns have been higher than average (green bars).

Does this mean it’s time to assume a position of maximum defensive portfolio positioning?

The full post can be found here.

Labels:

sentiment analysis,

Technical analysis,

Trend Model

Saturday, March 15, 2025

What are the odds of a Trump recession in 2025?

It’s an old political trick. Engineer a recession in your first year and blame it on the previous occupant of the White House. Then take credit for the subsequent recovery.

President Donald Trump and Treasury Secretary Scott Bessent recently rattled the markets with the same message of short-term pain for long-term gain. Bessent began with a CNBC interview outlining the Trump Administration’s intent to shift the source of economic growth from the public to the private sector. He added, “The market and the economy have just become hooked. We’ve become addicted to this government spending, and there’s going to be a detox period.”

In a separate interview, Trump said “a little time” may be needed for his tariff plan to start returning wealth to Americans. He acknowledged that the U.S. economy will undergo some short-term pain and declined to rule out a recession this year: “I hate to predict things like that. There is a period of transition because what we’re doing is very big.” Even more alarming to equity investors, he revealed that he wasn’t as concerned about the stock market as he had been during his first term in office: “Look, what I have to do is build a strong country. You can’t really watch the stock market. If you look at China, they have a 100-year perspective.”

So long to the Trump Put.

Could this “detox period” result in a recession in 2025? This matters because, as Callum Thomas observed, non-recessionary pullbacks tend to be short and shallow, while recessionary bear markets tend to see drawdowns last longer and deeper.

The full post can be found here.

Labels:

economy

Wednesday, March 12, 2025

The anatomy of a pullback, a trader's perspective

Mid-week market update: Everyone calm down. It's not the end of the world. A clear-headed approach is to analyze the roots of the pullback from the perspective of the positioning of different market participants. How each reacted, and what might come next.

First, U.S. equities were overvalued. It just needed a bearish catalyst.

Here's what happened next.

Labels:

Technical analysis

Sunday, March 9, 2025

High drama at the 200 dma

Preface: Explaining our market timing models

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 28-Feb-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A test of the 200 dma

The S&P 500 fell last week to test support at the 200 dma. Many elements of a tactical bottom are there, but not all. The 5-day RSI exhibited a bullish divergence and so did the 52-week highs-lows spread. The VIX Index is trading above the upper end of its Bollinger Band, indicating a deeply oversold condition. The only question mark is the lack of an oversold reading on the percentage of S&P 500 above their 20 dma (bottom panel).

The full post can be found here.

Labels:

sentiment analysis,

Technical analysis,

Trend Model

Saturday, March 8, 2025

Tops are processes

I sounded a warning in late January about a possible long-term market top, based on a negative divergence of the 14-month RSI. It wasn’t a “sell everything” signal, but a cautionary sign of a topping pattern.

It is said that “bottoms are events, but tops are processes”. That’s because market bottoms tend to be formed during panic events, while topping patterns tend to be longer-term drawn out. Here is a review of technical and macro backdrop supportive of my topping thesis.

It is said that “bottoms are events, but tops are processes”. That’s because market bottoms tend to be formed during panic events, while topping patterns tend to be longer-term drawn out. Here is a review of technical and macro backdrop supportive of my topping thesis.

The full post can be found here.

Labels:

economy,

Technical analysis

Wednesday, March 5, 2025

A guide to market bottoms, and what kind

Mid-week market update: The S&P 500 fell yesterday and briefly kissed its 200 dma while flashing a positive divergence on the 5-day RSI. Was that the bottom?

Here is a lesson on how to spot market bottoms, and a review of bottom spotting indicators.

Labels:

sentiment analysis,

Technical analysis

Tuesday, March 4, 2025

A golden opportunity

Gold has caught a bid against a backdrop of trade war fears. On the other hand, gold ETF AUM are skyrocketing, which is contrarian bearish.

The full post can be found here.

Labels:

gold

Sunday, March 2, 2025

What should you buy as the Magnificent Seven falters?

Preface: Explaining our market timing models

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Neutral (Last changed from “bullish” on 17-Jan-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

The end of American Exceptionalism?

U.S. equities have been on a tear relative to non-U.S. markets since the GFC. Now that the S&P 500 has stumbled while Europe and China have taken the lead, I am seeing some calls for the end of American exceptionalism, especially in light of the deteriorating relationship between America and its traditional allies.

The reversal was underscored by widespread concerns over the overvaluation of U.S. equities.

Is it time for investors to pivot into non-U.S. equities?

The full post can be found here.

Labels:

sentiment analysis,

Technical analysis,

Trend Model

Saturday, March 1, 2025

Bessent gets his wish, but not in a good way

Treasury Secretary Scott Bessent recently declared that the Trump Administration was mainly focused on lower the 10-year Treasury yield. He seems to be accomplishing his goals. Yields are moderating, and the MOVE Index, which measures bond market volatility, is relatively tame. He is achieving his objective, but at a price – by tanking the economy.

Labels:

economy

Wednesday, February 26, 2025

Trading is hard, my head hurts

Mid-week market update: Is the correction over? The S&P 500 was down -3% on a peak-to-trough basis. The 5-day RSI is severely oversold, which has signaled relief rallies in the past (blue circles). On the other hand, the percentage of stocks above their 20 dma is not oversold, which have been more definitive signals of durable bottoms (pink vertical lines). As well the NYSE net highs-lows is showing both a series of higher lows and lower highs.

Trading is hard. My head hurts.

Labels:

sentiment analysis,

Technical analysis

Sunday, February 23, 2025

White smoke from the market's conclave?

Preface: Explaining our market timing models

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Neutral (Last changed from “bullish” on 17-Jan-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

The market’s conclave

The recently released film entitled “Conclave” tells the story of how Vatican cardinals sought to elect a new pope after the death of the old one. The film is focused on the conclave, or the meeting of cardinals, as they are locked up in the Vatican and the political maneuvers of the different factions in electing their candidate. The situation is fluid and emerging leadership is highly uncertain.

That’s where the stock market is today. The large-cap growth old leadership is faltering, and different candidates are vying for the top spot. I use RRG charts to tell the story. Relative Rotation Graphs, or RRG charts, are a way of depicting the changes in leadership in different groups, such as sectors, countries or regions, or market factors. The charts are organized into four quadrants. The typical group rotation pattern occurs in a clockwise fashion. Leading groups (top right) deteriorate to weakening groups (bottom right), which then rotates to lagging groups (bottom left), which changes to improving groups (top left), and finally completes the cycle by improving to leading groups (top right) again.

An analysis of RRG rotation shows that growth sectors, technology, communication services and consumer discretionary, which is dominated by Magnificent Seven giants Amazon and Tesla, are weakening. While technology and communication services remain in the top right leading quadrant, they are likely to fall into the bottom right weakening quadrant in the near future if they follow the normal clockwise rotation pattern.

The contenders for the new leadership are value stocks, consisting of financials, industrials, energy and materials, and defensive stocks, consisting of healthcare, consumer staples, utilities and real estate. A growth to value rotation would mean a bullish and benign internal rotation for stock prices, while the emergence of defensive sectors as market leaders is a signal of a market pullback.

In the meantime, the market is waiting for the white smoke from the market’s conclave that signals which faction won in the end.

The full post can be found here.

Labels:

sector analysis,

Technical analysis,

Trend Model

Saturday, February 22, 2025

Could a cyclical rebound give the bulls a second wind?

Callum Thomas of Topdown Charts recently argued for the emergence of a global cyclical rebound based on a synchronized central bank easing. Such a scenario of rising inflationary pressures is a signal of a renewal of cyclical rebound in demand.

I have some sympathy to that view. I have been bullish on gold for some time, and gold is the classic hedge against unexpected inflation. On the other hand, it runs contrary to my observation that the S&P 500 is undergoing a topping formation (see A Long-Term Sell Signal?).

What’s the real story?

Labels:

equity markets,

Technical analysis

Subscribe to:

Posts (Atom)