Trend Model signal summary

Trend Model signal: Risk-off

Trading model: Bearish (downgrade)

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found

here.

Update schedule: I generally update Trend Model readings on

my blog on weekends and tweet any changes during the week at @humblestudent.

More choppiness ahead

Last week, I featured a chart showing the progress of the SPX compared to past market "crashes". I indicated that my best "wild-eyed guess" would be a rally last week, followed by a decline the week after (see

A V or W shaped bottom?). The market has followed that script well so far. Next week will see a test of how strong the bearish forces are.

I continue to believe that the US stock market is making a choppy bottom as patterned by the chart above. Fundamentals are supportive of higher stock prices (see

The right and wrong way to analyze earnings) and the latest macro outlook from

New Deal democrat shows no recession ahead, which is a leading cause of bear markets. Short leading indicators are a little soft, but long leading indicators continue to point to robust economic growth:

Among long leading indicators, interest rates for corporate bonds and treasuries remained neutral. Mortgage rates are positive, while purchase and refinance mortgage applications are slight positives. Real estate loans are positive. Money supply is positive.

Among short leading indicators, the interest rate spread between corporates and treasuries is its worst in 3 years. The US$ also turned even more negative. Temporary staffing was negative for the 18th week in a row. Positives included jobless claims, oil and gas prices, and gas usage. Commodities remain a big global negative.

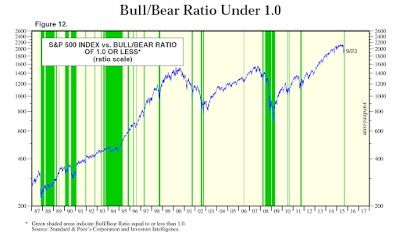

Sentiment models are still off the charts bearish, which is contrarian bullish for equities. While the combination of bullish macro, fundamental and sentiment indicators all point to higher stock prices, these models are imprecise at pinpointing the exact day or week of the market bottom. In the short-term, the stock market faces a number of challenges that could see some downside volatility in the days ahead.

Let me explain.

Excessive fear puts a floor on prices

This is starting to sound like a broken record, but sentiment models are still showing a crowded short, which is contrarian bullish and should put a floor on stock prices. This chart of Rydex cash flows shows that the level of bearishness is at a 16-year high, indicating extreme fear from individual investors.

The

NAAIM survey, which measures RIA sentiment, shows that bearishness has slightly receded but fear levels remain high.

The latest BoAML Fund Manager Survey, which mainly measures the sentiment of global institutional portfolio managers, shows that this group at high levels of defensiveness. Their global growth expectations are turning down.

As a consequence, equity allocations have fallen.

The selling has been mainly in UK and Japanese stocks and they bought into the US market, indicating a reduce market beta and therefore a flight to safety.

Their fear of an emerging market meltdown has spiked:

In the face high levels of fear and caution from individual investors (Rydex), US investment advisors (NAAIM) and global institutional managers (BoAML FMS), "smart money" insiders are contrarian bullish and they have been buying heavily since mid-August (via

Barron`s):

There have been a number of technical analysts who are forecasting considerably lower prices for stocks. Examples include

Chris Ciovacco who postulated SPX downside potential at 1680 and

Michael Kahn with a downside target of 1577, indicating downside risk of 20% or more in stock prices.

While I do understand the benefits of technical analysis and use it extensively in my own work, bear markets simply do not start with sentiment at such off the charts fear levels. That's why my inner investor remains in a "buy weakness" mode, with the belief that equity prices will be considerably higher by year end.

Near term challenges

Near term, however, the US equity market faces a number of challenges, any of which could be the source of downside volatility in the days ahead:

- US monetary policy: I had expected either a "dovish hike" or "hawkish pass" in the FOMC decision last week, but the statement was far more dovish than either the market or I had anticipated (see Does the FOMC decision matter much to the markets). Janet Yellen is scheduled to speak this coming Thursday, at which time she will likely explain the thinking behind the interest rate decision. If the FOMC statement is already dovish, any change in her posture is a more hawkish tilt - which would likely be a bearish development.

- US fiscal policy: In case anyone has forgotten, the US government faces the possibility of a government shutdown and a split in the Republican ranks. That scenario has not been discussed much by analysts and could quickly become a negative for the markets.

- Greece: Greece (yes, remember that Greece?) is holding parliamentary elections this Sunday whose results are not final at the time of this writing. While Alexis Tspiras's SYRIZA appears to have won his party does not have a majority and there may be a lot of bargaining in the days ahead. At best, we will see a continuation of the status quo. At worse, we could see political deadlock and more uncertainty in the eurozone. This Bloomberg article summarizes the upside and downside risks, which appear to be asymmetrically tilted to the downside.

- Spain: Catalan is holding elections on September 27 and the stakes are high. Bloomberg reported that "regional President Artur Mas has framed it as a de facto referendum on independence". The politics of Europe, which had been dormant since the summer, are heating up again and risk premiums in Europe have nowhere to go but up.

- China: President Xi is scheduled to visit the US next week. Expect greater scrutiny of Chinese economic weakness, as exemplified by the angst expressed by Martin Wolf over Willem Buiter's "made in China" global recession scenario and speculation about further RMB devaluation. As well, watch for an intense focus on security issues such as cyber spying and the tensions in the South China Sea (see this Sydney Morning Herald primer on the situation in the SCS).

In short, there are lots of catalysts for volatility, but the risks are mostly tilted to the downside. The market is already technically vulnerable, we just need something to lit the fuse.

How far down?

Chad Gassaway showed analysis a week ago indicating that September option expiry week (OpEx), which was last week, tended to have an overwhelming bullish seasonal bias (which was true, up until the FOMC meeting) and while the following week, next week, has a bearish bias.

Ryan Detrick also pointed out that average returns during the week after OpEx in September is the worst of the year of any post-OpEx week in the year.

In fact, the next three weeks have shown very poor returns on a seasonal basis.

So far, the part about strong OpEx week returns in September was correct this year. We saw the ramp into the FOMC decision last week. I warned on Wednesday morning that the stock market was getting overbought.

...and I shorted into the strength of the FOMC inspired rally on Thursday.

Now that we have seen the rally, it`s time for prices to mean revert and next week will present a test of the strength of the bears. How far can stocks fall?

A glance at the SPX chart tells us that multiple uptrends have been broken, both at price and momentum levels, which confirm the near-term bearish outlook. Initial support levels to watch for is 1940-1945 and secondary support exists at 1910-1915. If those don`t hold, expect a test of the August low support at 1860-1870. Should that fail, there will be further technical support at the November 2014 lows at about 1820.

Could the SPX actually get down as far as 1860-70, or 1820? In the past few weeks, we have seen a choppy market pattern where a trading strategy of buying weakness and fading strength has been highly profitable since the August bottom. Already, we are seeing short-term (1-3 day) overbought conditions being worked off, as per this chart from

IndexIndicators. It will only take one more big down day like Friday for this metric of stocks above the 10 dma metric to reach oversold levels. A retreat to 1870 would take this breadth measure to an extreme oversold reading, which has been inconsistent with the market conditions seen so far in September.

On the other hand, longer term (1-2 week) indicators remain in neutral territory and further weakness like the ones we saw on Friday will not move this indicator into the oversold target zone. So it would not be unreasonable to see the market weaken to levels where longer term (1-2 week) indicators flash oversold readings.

The week ahead will therefore be a big test for the bears. Will bearish momentum be strong enough to overcome short-term (1-3 day) oversold readings and push prices lower to test the August and possibly November lows?

Stay tuned.

My inner trader turned flipped from long to short on Thursday with the FOMC rally. His plan is to start to scale out of short positions should the market flash short-term oversold conditions and then watch how the market responds before making further decisions.

Disclosure: Long SPXU