Thursday, December 31, 2020

My 2020 report card

Wednesday, December 30, 2020

Steady as she goes

Sunday, December 27, 2020

When does Santa's party end?

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

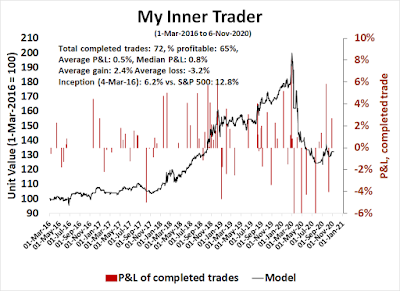

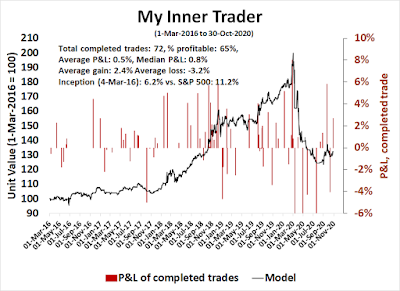

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The seasonal party

Saturday, December 26, 2020

Debunking the Buffett Indicator

Wednesday, December 23, 2020

The most wonderful time of the year...

Mid-week market update: In my last post (see Trading the pre-Christmas panic), I pointed out that the VIX Index had spiked above its upper Bollinger Band, which is an indication of an oversold market. In the past year, stock prices have usually stabilized and rallied after such signals (blue vertical line). The only major exception was the February and March skid that saw the market become more and more oversold (red line). The market today appears to be following a more typical pattern of stabilization, which should be followed by recovery during the seasonally strong Christmas period.

Even more constructive for the bull case was how stock prices reacted to bad news. Last night after the market close, President Trump called the latest stimulus package a "disgrace" and threatened to veto the bill. This latest surprise not only threatens the stimulus bill, it also raises the risk of a government shutdown on December 28, 2020. S&P 500 futures initially fell -0.5% overnight on the news but recovered to open green Wednesday morning.

A market's ability to shrug off bad news is bullish.

The full post can be found here.

Monday, December 21, 2020

Trading the pre-Christmas panic

Sunday, December 20, 2020

Santa rally, Version 2020

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The Santa Claus effect

Saturday, December 19, 2020

Will Biden reset the Sino-American relationship?

- What does each side want, and what are the sources of friction?

- What constraints is China operating under?

- What's the likely path forward?

Wednesday, December 16, 2020

Waiting for the breakout

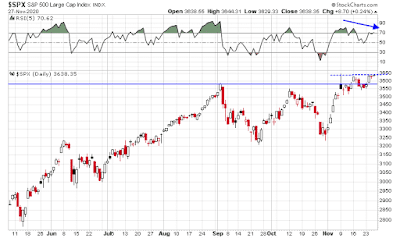

Mid-week market update: It's difficult to make a coherent technical analysis comment on the day of an FOMC meeting, but the stock market remains in a holding pattern. While the S&P 500 remains in an uptrend (blue line), it has been consolidating sideways since late November and early December.

Until we see either an upside breakout or downside breakdown out of the trading range (grey area), it's difficult to make a definitive directional call either way. The bull can point to a brief spike of the VIX above its upper Bollinger Band on Monday, which is a sign of an oversold market. TRIN also rose to 2 on Monday, which can be an indication of panic selling. As well, the VIX Index is normalizing relative to EM VIX since the election. The US market has stopped acting like an emerging market as anxieties have receded. As the S&P 500 tests the top of the range, these are constructive signs that the market is about to rise. On the other hand, the bears can say that even with all these tailwinds, the stock market remains range-bound and unable to stage an upside breakout, indicating that the bulls are having trouble seizing control of the tape.

The full post can be found here.

Sunday, December 13, 2020

How far can stocks pull back?

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The ketchup effect

Saturday, December 12, 2020

Time for another year-end FOMO stampede?

In late 2017, the stock market melted up in a FOMO (Fear Of Missing Out) stampede as enthusiasm about the Trump tax cuts gripped investor psychology. The market corrected in early 2018 and rose steadily into October, though the advance could not be characterized as a melt-up. In late 2019, the market staged a similar FOMO stampede and the rally was halted by the news of the pandemic spreading around the world.

In each of the above cases, the Fear & Greed Index followed a pattern of an initial high, a retreat, followed by a higher high either coincident or ahead of the ultimate stock market peak.

Could we see a similar year-end melt-up in 2020?

The full post can be found here.

Wednesday, December 9, 2020

The bearish window is closing quickly

Tuesday, December 8, 2020

Why you should and shouldn't invest in Bitcoin

In response to my recent publication (see A focus on gold and energy), a number of readers asked, "What about Bitcoin (BTC)?" Indeed, BTC has diverged and beaten gold recently. Even as gold prices corrected, BTC has been rising steadily since early October.

Here are the reasons why you should and shouldn't invest in Bitcoin.

The full post can be found here.

Sunday, December 6, 2020

Melt-up, or meltdown?

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

An overbought market

Saturday, December 5, 2020

A focus on gold and oil

I received considerable feedback from last week's publication (see How to outperform by 50-250% over 2-3 years), mostly related to gold and energy stocks.

In last week's analysis, I had lumped these groups in with other cyclicals. Examining them further, I believe they have bright futures ahead of them.

The full post can be found here.

Wednesday, December 2, 2020

The bears' chance to make a stand

Monday, November 30, 2020

Will Powell twist?

Jens Nordvig recently conducted an unscientific Twitter poll on the FOMC's action at the December meeting/ While there was a small plurality leaning towards a "steady as she goes" course, there was a significant minority calling for another Operation Twist, in which the Fed shifts buying from the short end to the medium and long ends of the yield curve.

The November FOMC minutes reveal no clear consensus on the prospect of a twist, otherwise known as yield curve control (YCC).

A few participants indicated that asset purchases could also help guard against undesirable upward pressure on longer-term rates that could arise, for example, from higher-than-expected Treasury debt issuance. Several participants noted the possibility that there may be limits to the amount of additional accommodation that could be provided through increases in the Federal Reserve's asset holdings in light of the low level of longer-term yields, and they expressed concerns that a significant expansion in asset holdings could have unintended consequences.

Here is why that matters.

The full post can be found here.

Sunday, November 29, 2020

A Wall of Worry, or Slope of Hope?

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The proverbial Wall of Worry

Saturday, November 28, 2020

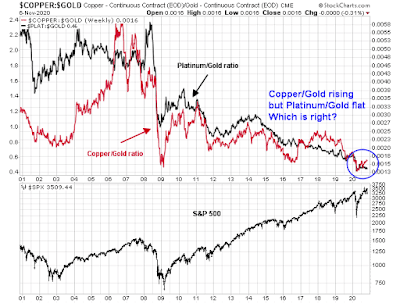

How to outperform by 50-250% over 2-3 years

Investors are increasingly convinced that the cyclical and Great Rotation trade is very real and long-lasting (see Everything you need to know about the Great Rotation but were afraid to ask). That should be bullish for the S&P 500, right?

Well, sort of.

Despite the cyclical and reflationary tailwinds for stocks, the S&P 500 has a weighting problem. About 44% of its weight is concentrated in Big Tech (technology, communication services, and Amazon). The top five sectors comprise nearly 70% of index weight, and it would be difficult for the index to meaningfully advance without the participation of a majority of these sectors. However, an analysis of the relative performance of the top five sectors does not exactly inspire confidence as to the sustainability of an advance. Technology relative strength, which is the biggest sector, is rolling over. Healthcare is weak. Neither consumer discretionary nor communication services are showing any signs of leadership. Only financial stocks, which represent the smallest of the top five sectors, is exhibiting some emerging relative strength.

There are better investment opportunities, and investors can potentially outperform by a cumulative 50-250% over the next 2-3 years.

The full post can be found here.

Tuesday, November 24, 2020

Do the bulls have a sentiment problem?

Mid-week market update: (I am publishing my mid-week market update a day early owing to the US Thanksgiving holiday shortened week)

Should the bulls be worried? The Greed and Fear Index has surged to 88, which represents a warning of excessive bullishness.

As well, Willie Delwiche pointed out that his survey of sentiment indicators are all tilted either contrarian bearish or neutral. Delwiche concluded that "everyone knows about (& is positioned for) historical tendency for stocks to rally from here into year-end".

The full post can be found here.

Sunday, November 22, 2020

Too far, too fast?

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Rainbows and unicorns?

Saturday, November 21, 2020

Will Mnuchin and COVID-19 derail the cyclical bullish rebound?

I hope that I haven't offended the market gods. Just after my bullish call for a cyclical recovery (see Everything you need to know about the Great Rotation but were afraid to ask), a number of contrary data points have appeared to cast doubt on the reflation thesis.

The markets were jolted by the news on Thursday that Secretary Treasury Mnuchin has declined to extend CARES Act emergency lending facilities established with the Federal Reserve. In addition, Treasury has asked the Fed to return any unused funds. This is a potentially contractionary fiscal development and a possible preview of the spending tug-of-war between a Biden White House and a Republican-controlled Senate.

As well, the ongoing risk posed by a second wave of COVID-19 in Europe, and a third wave in the US derail the cyclical bull? The resurgence of the virus is quite clear in the US, as evidenced by rising policy stringency. In Europe, things have become so bad that even the Swedes have abandoned the Swedish model and announced shutdowns.

High-frequency data, such as Chase card spending, is turning down.

Are these sufficient negative surprises for equity investors to be worried about? Let's consider the bull and bear cases.

The full post can be found here.

Wednesday, November 18, 2020

A crowded long, or a "good overbought" advance?

Mid-week market update: In case you missed it, the Dow Theory flashed a definitive buy signal. Both the Dow Jones Industrial and Transportation Averages made all-time highs on Monday. This is the granddaddy of all technical analysis systems, and investors should sit up and pay attention. Moreover, the Dow may be tracing out a series of "good overbought" conditions that are indicative of a sustained rally.

On the other hand, sentiment models are flashing crowded long and overbought signals. Is the market ripe for a pullback, or is this the start of a "good overbought" advance?

The full post can be found here.

Monday, November 16, 2020

Value picks and pans

Sunday, November 15, 2020

Still testing triple-top resistance

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The bulls test triple-top resistance

Saturday, November 14, 2020

Everything you need to know about the Great Rotation, but were afraid to ask

The market lurched upwards on Vaccine Monday on the Pfizer-BioNTech news that it had found promising results in its vaccine trial. In a "Great Rotation", investors piled into value stocks and abandoned former growth darlings. The Daily Shot published this chart from Goldman Sachs estimating how a successful vaccine rollout could impact sectors. But that's not the entire story.

Wednesday, November 11, 2020

ZBT missed - again!

Mid-week market update: It is ironic that four weeks ago today, I pointed out that the market missed flashing a rare Zweig Breadth Thrust buy signal by one day (see Trading the breadth thrust). Market breadth, as measured by the ZBT Indicator, has to rise from an oversold level of 0.40 to an overbought reading of 0.615 or more within a 10-day window. Four weeks ago, it achieved that in 11 days, and the rally fizzled sooner afterward.

The ZBT buy signal is extremely rare, and it has occurred only six times since 2004. In all instances, the market has been higher in 12-months, though it "failed" on two occasions inasmuch as it pulled back before roaring ahead to new highs.

I observed on the weekend that we are on the verge of another possible ZBT buy signal (see Zweig Breadth Thrust and triple-top watch). The 10-day window ends today. Alas, the ZBT just failed to flash a buy signal. It topped out yesterday (Tuesday) at 0.606, which was just short of its 0.615 target, and it retreated today.

Despite the setback, all may not be lost.

The full post can be found here.

Sunday, November 8, 2020

Zweig Breadth Thrust and triple-top watch

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Breadth Thrust, or triple top?

Saturday, November 7, 2020

Growth, interrupted?

Two weeks ago, I rhetorically asked if investors should be buying into the cyclical recovery theme (see Buy the cyclical and reflation trade?). Global green shoots of recovery were appearing, but I identified the "uncertainty of additional fiscal stimulus" as a key risk to the cyclical rebound thesis. Now that Biden appears to be winning the White House, but constrained by a Republican-controlled Senate, it's time to revisit the recovery question.

Regular readers know that I consider the global economy as three trade blocs, NAFTA, Europe, and Asia dominated by China. It is within that framework that I examine the global reflation question.

Is the global economy emerging from a global recession?

The full post can be found here.

Wednesday, November 4, 2020

Interpreting the market's election reaction

Mid-week market update: It's always instructive to see how the market reacts to the news. If I had told you that the dual market nightmare scenarios of a contested election and a deadlocked election consisting of a Biden Presidency and a Republican-controlled Senate were to come true, would you expect the market to take a risk-on or risk-off tone?

Based on publicly available reports, Biden is on his way to the White House. If he were to win all the states that he is leading in, Biden would win the Presidency. As well, the Republicans have retained control of the Senate, which puts the idea of a Blue Wave sweep to rest. That said, the presidential election is very close and subject to challenge. The likelihood of a contested election that winds up in the courts, and the streets, is high.

In the face of all this uncertainty, the S&P 500 melted up to regain its 50 dma.

The full post can be found here.

Monday, November 2, 2020

Oh yeah, it's also FOMC meeting week

What's on the calendar this week? Did you forget?

Oh yeah, there's an FOMC meeting this week, and there's the November Jobs Report on Friday. While not much policy change is expected from the Fed this week, Barron's has already anointed Jerome Powell as "the winner". (Has anyone started to call him the Maestro yet?)

Before everyone gets too excited, here are the challenges facing the Fed in the post-electoral and pandemic era.

The full post can be found here.

Sunday, November 1, 2020

Scenario planning ahead of the Big Event

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Bearish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

Waiting for the Big Event

Saturday, October 31, 2020

Emerging tail-risk: An invasion of Taiwan

I am not in the habit of peddling conspiracy theories, but this is inadvertently becoming a Halloween tradition. Last Halloween, I wrote about how China could control Taiwan without firing a shot (see Scary Halloween story: How a weak USD could hand China a major victory). This year, a new geopolitical tail-risk is materializing for investors and for global stability. China's People's Daily recently published a “Letter to Taiwan’s Intelligence Organs” warning Taiwanese intelligence agencies against supporting President Tsai Ing-wen’s resistance to China's unification efforts (article in Chinese here, Facebook summary in English here).

People’s Daily on Thursday urged intelligence agencies in Taiwan to stay away from the “fatal track” of seeking Taiwan’s independence, which only leads to self-annihilation and is doomed to fail.

In the released Message to Taiwan’s Intelligence agencies, the Chinese mainland firmly opposed those independence-seeking diehards of the blind to allay their tiger-riding behaviors, and advised them to get a clear understanding of the situation and get back to the correct track, the only correct way of stopping them from dead ends.

“Don’t say I didn’t warn you,” said the message.

The message also reiterated that the Chinese mainland and Taiwan island share the same blood and same culture, and the mainland always welcomes variety of cooperation through different channels and encourages exchanges and dialogues with people of insight in Taiwan.

The warning was little noticed by most Western media. What was ominous was the phrase, "Don't say I didn't warn you" (勿谓言之不预也). Similar language was used by China when it launched military offensives in the past. It used that phrasing when it issued a "surrender or die" ultimatum to the nationalist garrison in Beijing in 1949. it warned American-led forces in Korea not to approach its Yalu River border in 1950; it warned India before attacking in 1962; and it issued a similar warning before the invasion of Vietnam in 1978.

This is not a drill.

The full post can be found here.