It is in that context when, later in the day, the three-judge panel of the U.S. Court of International Trade unanimously ruled against the Trump Administration in VOS Selections v U.S. and struck down a whole range of tariffs by citing a lack of authority. The most equity bullish outcome would have been Trump taking this legal exit ramp to retreat from his trade war. Instead, he doubled down with the following social media message, possibly egged on by the TACO question. What was even more disturbing was the inclusion of Pepe the frog (my highlight), which was an image appropriated by White supremacists during the 2016 election.

Saturday, May 31, 2025

Don't buy that TACO just yet

It is in that context when, later in the day, the three-judge panel of the U.S. Court of International Trade unanimously ruled against the Trump Administration in VOS Selections v U.S. and struck down a whole range of tariffs by citing a lack of authority. The most equity bullish outcome would have been Trump taking this legal exit ramp to retreat from his trade war. Instead, he doubled down with the following social media message, possibly egged on by the TACO question. What was even more disturbing was the inclusion of Pepe the frog (my highlight), which was an image appropriated by White supremacists during the 2016 election.

Wednesday, May 28, 2025

Don't just obsess over NVIDIA

The full post can be found here.

Sunday, May 25, 2025

Bond vigilantes and trade tensions derail the momentum bull

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “neutral” on 16-May-2025)*

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Wide Trading Range

Saturday, May 24, 2025

Sell America = Buy Gold

I believe this is just the start of a secular bull cycle for gold prices, based on a secular Sell America investment cycle.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Wednesday, May 21, 2025

Is Sell America sneaking up on the equity bulls?

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Sunday, May 18, 2025

S&P 500: A Healing Patient Who Needs Rest

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bearish (Last changed from “neutral” on 11-Apr-2025)*

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Bullish Recovery

The bullish recovery of the S&P 500 has been astounding in speed and magnitude. Not only has the S&P 500 regained its 200 dma, but also the NYSE Advance-Decline Line has made an all-time high. This is a welcome bullish development. That said, weakness in the mid- and small-cap A-D Lines is disconcerting.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Saturday, May 17, 2025

What the Trade Détente Means for Investors

The agreement. lowered the U.S. tariff on Chinese imports from 145% to 30% for 90 days. China reciprocated by lowering its tariffs on U.S. imports to 10%. Shipping bookings skyrocketed in response and the deal took the tail-risk of a recession off the table.

Here’s what the trade détente means for investors.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Wednesday, May 14, 2025

From Fear to Greed

Sunday, May 11, 2025

A Sector and Factor Review of Market Internals

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bearish (Last changed from “neutral” on 11-Apr-2025)*

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Leadership Review

The recovery of the S&P 500 off the “Liberation Day” downdraft seems to be stalling just below the 200 dma. A review of value and growth leadership shows that the rebound was led by growth stocks, both on a global basis and across all market cap bands.

Does that mean the rally is vulnerable to a setback in growth names? We review the character of market leadership to answer that question.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Saturday, May 10, 2025

Why the Detox Isn't Over

I don’t think so.

The stock market isn’t the economy, but it is nevertheless related to the economy. Investors need to distinguish between the likely economic effects of events and the market reaction to the events. The initial VIX spike to over 60 in the wake of the “Liberation Day” announcement was consistent with the blinding end-of-world fear that occurs at market bottoms. Usually, the subsequent bottom has been accompanied by the reduction or elimination of tail-risk by policy makers. This time, the tail-risk of a recession is very real and there are no signs of significant policy mitigation.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Wednesday, May 7, 2025

The Eyes of the Beholder

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Sunday, May 4, 2025

Trust the Thrust, or Sell in May?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bearish (Last changed from “neutral” on 11-Apr-2025)*

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

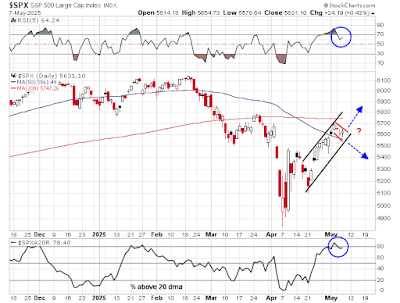

Buy and Sell Signals

The S&P 500 made an impressive recovery off the trade war panic sell-off. The market regained the 50 dma and it stands above “Liberation Day” levels, though the index is overbought and it is encountering a zone of resistance.

Along with the market recovery, I am seeing a resurgence of momentum-driven buy signals, or at least constructive signs for stock prices. Against that, the stock market is also facing a number of bearish headwinds, such as the “Sell in May” negative seasonality influence.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Saturday, May 3, 2025

A Trend Model update: Still cautious

The risk-adjusted returns of the model portfolio are strong. The model has beaten the 60/40 benchmark on 1, 2, 3 and 5-year time horizons, as well from inception for the period from December 31, 2013 to April 29, 2025. In addition, it was able to achieve these returns with controlled risk, equivalent to roughly an 85/15 stock/bond asset mix with 60/40 risk. As the dotted line in the chart depicting relative performance shows, the model mainly reached the superior risk-adjusted returns by sidestepping the really ugly bear markets over the study period.

- 1 year: Model 9.5% vs. 60/40 8.7%

- 2 years: Model 13.3% vs. 60/40 11.4%

- 3 years: Model 9.6% vs. 60/40 7.7%

- 5 years: Model 10.9% vs. 60/40 9.0%

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.