Trend Model signal: Risk-on

Trading model: Bullish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found here.

Update schedule: I generally update Trend Model readings on my blog on weekends and tweet any changes during the week at @humblestudent.

Bear markets just don't start this way

Last week, I wrote that I remained bullish but there were lines in the sand for the bears to cross (see Bullish, but "data dependent"). While I remain data dependent, I continue to give the bull case the benefit of the doubt for the following reasons:

- The intermediate bull trend remains intact

- Markets are oversold and sentiment is moving to a crowded short reading

- Fundamentals are poised to turn around

- The internals of market leadership do not suggest the start of a bear phase

Bull trend still intact

Last week, I wrote that the SPX was tactically oversold on the 5-day RSI and could be due for a bounce. We saw a weak rally on Monday, which I interpreted in a tweet to a weak bounce and believed that a final sell-off was in order.

At the close on Tuesday, I wrote that the it appeared that we were getting close to a capitulation bottom (see Getting close to a ST market bottom) and confirmed my beliefs in a tweet at the close on Thursday.

However, instead of the bulls delivering a follow-through rally as they have done in the past rallies off V-shaped bottoms, the markets instead saw a Friday the 13th surprise sell-off. The bull trend was saved by a bounce off the uptrend line that began last October. In fact, a review of the charts, both within the US and globally, indicate that the bull trend is still intact. The chart below of global, US and European equity averages show a pattern of a pullback to successfully test the uptrend.

A crowded short is developing

In the meantime, the market is getting oversold and sentiment readings are turning bearish, which is contrarian bullish. Bespoke reports that AAII bullish sentiment has dropped like a rock, though bearish readings have not risen as the (former) bulls turned neutral.

As well, the latest NAAIM survey shows that sentiment has fallen precipitously from 92 to 65 in a single week, which indicates panic among the RIA community. Here is the chart of sentiment readings:

Here is the data:

Here are also some selected charts from IndexIndicators.com, which show that the SPX to be oversold enough that it has staged short-term rallies in the past. It does not mean, however, that the market cannot get more oversold. Here is a chart of the % of SPX stocks at 20-day lows:

And average 14-day RSI of SPX components:

You get the idea. While I believe that stocks are poised to rally, we have a wildcard in the form of the FOMC meeting next week, which could create further asset price volatility.

Poised for a turnaround

Sentiment has become so negative that any hint of good news may create a melt-up in the price of risky assets. As an example, the much better than expected Employment Report on March 6 swung psychology to a June Fed rate hike, but inflation and inflationary expectations remain tame (see Why the Fed may stay "patient" for a little longer). While the FOMC may drop the word "patient" in its March statement, the possibility that it could be replaced by some equally dovish language under the circumstances.

In addition, there has been much concern over the GDPNow estimate of Q1 GDP from the Atlanta Fed, as those readings have been falling rapidly:

As well, Bloomberg reported that their ECO US Surprise Index, which measures economic data relative to market expectations, has fallen to levels not seen since 2009:

A turnaround may be at hand, according to New Deal democrat, who provides a far more nuanced interpretation of macro data by segregating them into coincidental, short and long leading indicators (emphasis added):

For another viewpoint, I turned to Brian Gilmartin, who keeps a close eye on the earnings outlook, Gilmartin believes that USD strength has eclipsed falling energy prices as a worry for forward EPS and that those concerns are overdone:

Bear market internals don't look like this

Further, a review of stock market sector and industry leadership is highly suggestive that this is not an intermediate term market top. Typically, topping patterns are preceded by the relative deterioration of high-beta glamour groups and the outperformance of defensive sectors. Here is a chart of the relative performance of two major defensive sectors. Are they beating the market? Tops normally don't start this way.

The underperforming groups are natural resource related, which is not a surprise given what has happened to oil and other commodities:

Here is a chart of the market leaders, which consist of Health Care, which has been a secular leadership sector this cycle, NASDAQ and Consumer Discretionary stocks. This pattern tells me that Mr. Market still believes that we are in the mid-cycle phase of an economic expansion:

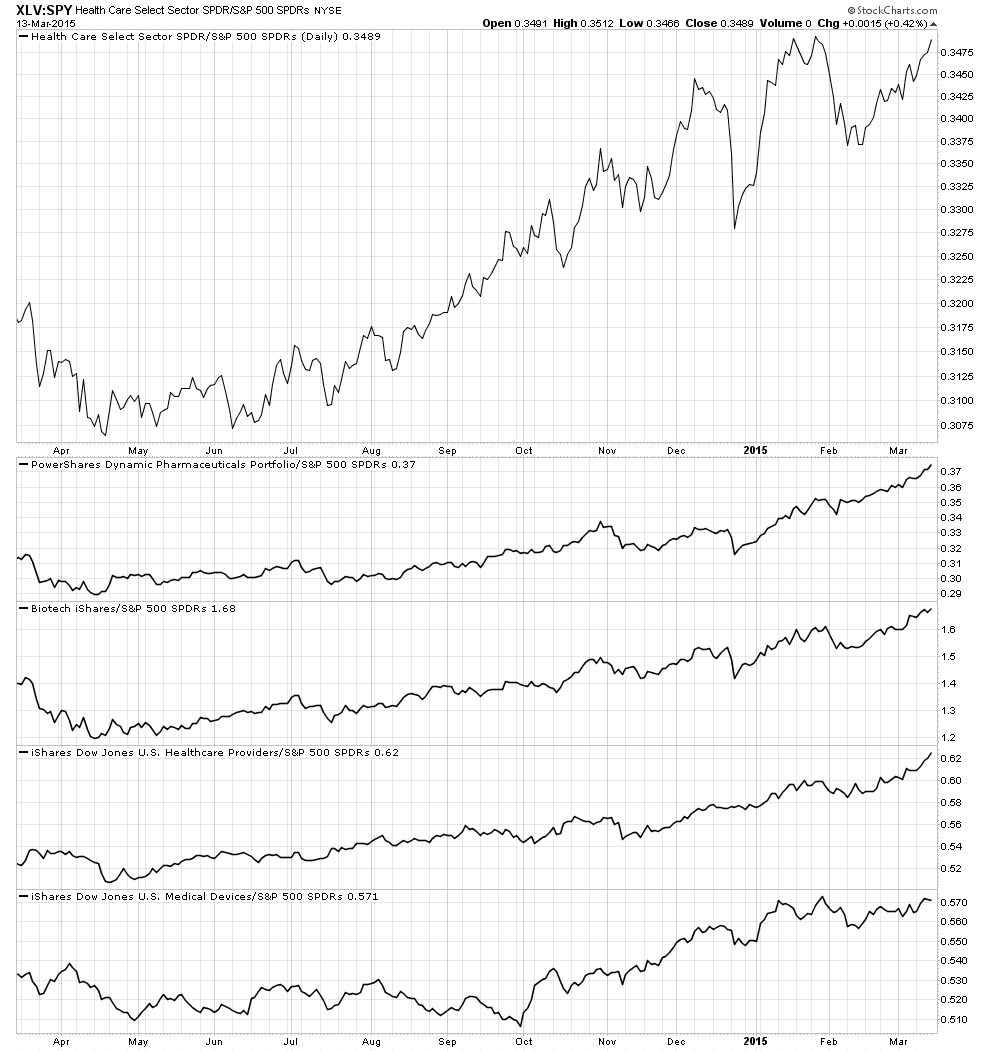

A closer examination of the Health Care sector that leadership has not been just restricted to biotech stocks, which have gone from strength to strength this cycle, but other individual industries in the sector:

Consumer Discretionary stocks have also been on a tear. Strength has been evident in virtually all consumer spending related groups:

NASDAQ stocks have also been showing strength. Glamour groups have also been showing rising relative strength, with the exception of the range-bound Social Media stocks,

Limited downside risk

My inner investor remains overweight risky assets.

My inner investor is long the market as he is positioned for the potential rebound to come. The key test for the stock market is what happens after the oversold rally peters out. Will it continue to grind upwards, exceed the old breakout at about 2093 and test new highs? Or will market strength stall out?

Disclosure: Long TQQQ

In addition, there has been much concern over the GDPNow estimate of Q1 GDP from the Atlanta Fed, as those readings have been falling rapidly:

The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2015 was 0.6 percent on March 12, down from 1.2 percent on March 6. The nowcast for first-quarter real consumption growth fell from 2.9 percent to 2.2 percent following this morning's retail sales release from the U.S. Census Bureau.

As well, Bloomberg reported that their ECO US Surprise Index, which measures economic data relative to market expectations, has fallen to levels not seen since 2009:

A turnaround may be at hand, according to New Deal democrat, who provides a far more nuanced interpretation of macro data by segregating them into coincidental, short and long leading indicators (emphasis added):

Negative coincident indicators have generally abated, with the big exception of Steel.In addition, the latest report from John Butters of Factset shows that bottom-up EPS estimates continue to recover from their recent weakness (annotations in red are mine):

Among long leading indicators, yields on corporate bonds and treasuries are still positive although less so. Money supply is even more positive. Real estate loans, and house sales as reported by DataQuick were positive. Mortgage applications were mixed

The short leading indicators also returned to generally positive readings. Oil prices fell back to their January low. Industrial metal prices rose slightly, but were still close to their recent low. Spreads between corporate bonds and treasuries improved slightly and I scoring them a slightly positive. Temporary staffing also returned to being positive. Gas prices and usage remained positive, and initial jobless claims improved within their positive range.

As indicated above, coincident readings largely abated from being quite negative. Rail, which had been awful, was mixed. Consumer spending as measured by Gallup was just barely positive yet for the first time in weeks, while Johnson Redbook was again only weakly positive. The TED spread and LIBOR have leveled off as barely negative. Shipping turned more positive, and tax withholding was positive as well. Only steel production was negative, and in a big way.

Last week the weakness in the high frequency data spread from coincident to short leading indicators. I remained positive, since this is not the order in which I would expect the economy to turn. This week's data bears that out. In particular I said, "I will be paying particular attention to rail and to Gallup consumer spending to see if they turn positive in the next several weeks, and to see if the temporary staffing downturn was just one week of noise." This week all three were positive.

For another viewpoint, I turned to Brian Gilmartin, who keeps a close eye on the earnings outlook, Gilmartin believes that USD strength has eclipsed falling energy prices as a worry for forward EPS and that those concerns are overdone:

I think there is a lot of bad news in the current 2015 earnings forecasts and numbers. I think the dollar is as much of an issue maybe more than Energy at this point, since it is tougher to quantify. Personally, despite the worries about the forward growth rate of the SP 500 earnings estimate going negative, I dont think we are anywhere close to a 2008-type scenario in the stock market. Despite the headline to this weekend’s update, I’m not that worried about SP 500 earnings.He concluded:

Even if the dollar were just stable for a month, and the euro stopped plummeting, I think that could take some pressure off estimates.Should a dovish Fed statement next week send the USD lower, it would precisely set up that kind of market psychology where USD weakness translates to greater EPS growth optimism.

Bear market internals don't look like this

Further, a review of stock market sector and industry leadership is highly suggestive that this is not an intermediate term market top. Typically, topping patterns are preceded by the relative deterioration of high-beta glamour groups and the outperformance of defensive sectors. Here is a chart of the relative performance of two major defensive sectors. Are they beating the market? Tops normally don't start this way.

The underperforming groups are natural resource related, which is not a surprise given what has happened to oil and other commodities:

Here is a chart of the market leaders, which consist of Health Care, which has been a secular leadership sector this cycle, NASDAQ and Consumer Discretionary stocks. This pattern tells me that Mr. Market still believes that we are in the mid-cycle phase of an economic expansion:

A closer examination of the Health Care sector that leadership has not been just restricted to biotech stocks, which have gone from strength to strength this cycle, but other individual industries in the sector:

Consumer Discretionary stocks have also been on a tear. Strength has been evident in virtually all consumer spending related groups:

NASDAQ stocks have also been showing strength. Glamour groups have also been showing rising relative strength, with the exception of the range-bound Social Media stocks,

Limited downside risk

When I put it all together, the big picture tells a story of some short-term weakness in the context of intermediate term strength. Expectations have been beaten down and crowded short positions are being formed. On the other hand, there is little sign of intermediate term weakness, either from a technical or fundamental perspective.

This doesnt mean that stocks will go up in a straight line, as the market reaction to the FOMC meeting is unpredicatable. However, I believe that downside risk is relatively limited. The SPX has the support of the uptrend line depicted below. Should that fail, recent episodes of weakness has been arrested at the 150 dma, which is about 1.5% below the levels seen on Friday.

This doesnt mean that stocks will go up in a straight line, as the market reaction to the FOMC meeting is unpredicatable. However, I believe that downside risk is relatively limited. The SPX has the support of the uptrend line depicted below. Should that fail, recent episodes of weakness has been arrested at the 150 dma, which is about 1.5% below the levels seen on Friday.

My inner investor remains overweight risky assets.

My inner investor is long the market as he is positioned for the potential rebound to come. The key test for the stock market is what happens after the oversold rally peters out. Will it continue to grind upwards, exceed the old breakout at about 2093 and test new highs? Or will market strength stall out?

Disclosure: Long TQQQ

No comments:

Post a Comment