We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts are updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

The proverbial Wall of Worry

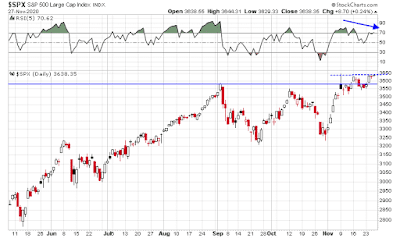

Two weeks ago, I turned decisively;u bullish on the market (see Everything you need to know about the Great Rotation but were afraid to ask). Since then, major market indices have staged upside breakouts to new highs. The market is overbought and exhibiting a minor negative RSI divergence.

While I remain intermediate-term bullish, the short-term outlook is less certain. Market sentiment is becoming a little frothy, and the market is vulnerable to a setback should any negative catalysts were to appear.

The bulls will say that the market is just climbing the proverbial Wall of Worry. The bears contend that it is nearing a Slope of Hope. What's the real story?

The full post can be found here.

No comments:

Post a Comment