We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

To boldly go?

Last week, I characterized the stock market as like a rocket on a launch pad. Last week's events also featured William Shatner, the actor who played Captain Kirk in the original Star Trek series, being blasted into space. Now that Captain Kirk has gone into space, will equities follow?

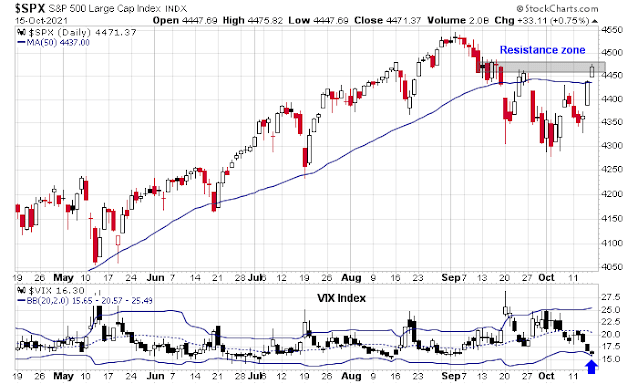

Let's take a look. One of the bullish tripwires I outlined was for the S&P 500 to decisively regain its 50 dma. The index convincingly breached the 50 dma and it is now testing a resistance zone, which is positive.

However, traders are cautioned to monitor the VIX Index. In the past, VIX breaches of the lower Bollinger Band have been overbought signals when market rallies have temporarily stalled in the past.

The full post can be found here.

No comments:

Post a Comment