We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity price. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

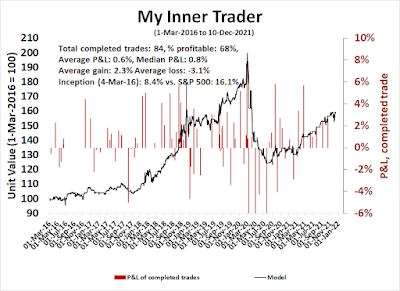

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

A data and political problem

The S&P 500 experienced an air pocket in late November, sparked by a combination of the news of the emergence of the Omicron virus variant and the Fed's hawkish surprise. Since then, the Omicron news has been mostly benign. While the new variant is more transmissible, its effects appear to be less severe. Pfizer and BioNTech reported that lab tests showed that a third dose of its vaccine protected against the Omicron variant. A two-dose regime was less effective but still prevents severe illness. With the Omicron threat off the table, the market staged a strong relief rally.

The second threat of a hawkish Fed still remains. As investors look ahead to the FOMC meeting next week, the Fed faces both a data and political inflation problem. The data problem is that inflation surprise is surging all around the world.

The full post can be found here.

No comments:

Post a Comment