We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bearish*

- Trading model: Bullish*

Update schedule: I generally update model readings on my site on weekends and tweet mid-week observations at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real-time here.

A crypto bank run

I had voiced my reservations about the cryptocurrency ecosystem in the past (see The brewing Lehman Crisis in Crypto-Land) and the risks manifested themselves in the last week. To briefly recap the problem, cryptocurrencies are mainly traded in the offshore market. A crypto trader can exchange USD for crypto, but banks do not allow direct access to crypto exchanges, with some exceptions. The crypto trader can exchange his USD for a stablecoin, which is a token that is theoretically backed 1 for 1 to the USD. He then exchanges his stablecoin to buy cryptocurrencies and back when he sells. When he wants USD in his account, he instructs the stablecoin provider to convert his stablecoin into USD, which is deposited to his onshore USD account.

The important piece of the crypto ecosystem plumbing is confidence in the stablecoin system. Stablecoins are supposed to be like money market funds, they shouldn't be trading below par. Last week, the TerraUSD stablecoin, also known as UST, broke its USD peg and sparked a crisis of confidence. Within the space of a few days, the value of LUNA had evaporated to zero. Crypto traders began a virtual bank run on stablecoins. Tether, the largest stablecoin, broke its peg last week, While prices have partly recovered and stabilized, Tether is still trading slightly below 1.

The crypto bank run set off a stampede of selling in cryptocurrencies and other speculative risk assets.

The big question for investors is whether the crypto meltdown will have a long-lasting effect on global risk appetite and risk aversion leak into the equity market. Was the Crypto meltdown last week the new LTCM moment for asset markets?

The full post can be found here.

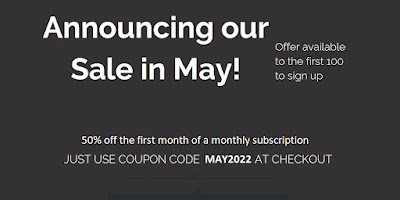

Sale in May

We would also like to announce our "Sale in May" event. Get 50% off a monthly subscription for the first month. Click here to subscribe.

No comments:

Post a Comment