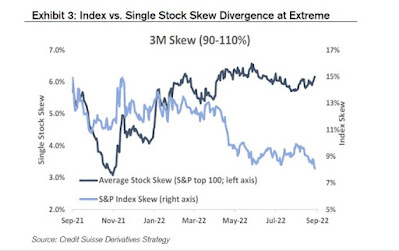

As we approach Q3 earnings season, an interesting divergence is appearing in the derivative markets. While the SKEW, which measures the price of option tail-risk, is low for the S&P 500, the SKEW for individual stocks has been elevated. This reflects rising anxiety about possible blow-ups in individual stocks as earnings season approaches.

Still, a review of the risks shows that not all is at it seems below the surface.

The full post can be found here.

No comments:

Post a Comment