Preface: Explaining our market timing models We maintain several market timing models, each with differing time horizons. The "

Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

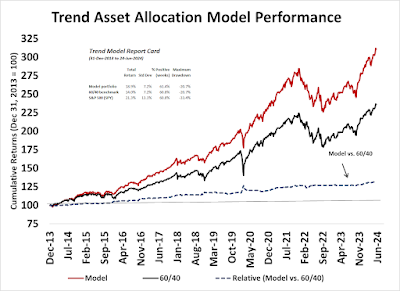

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

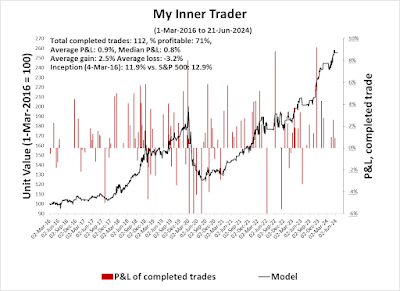

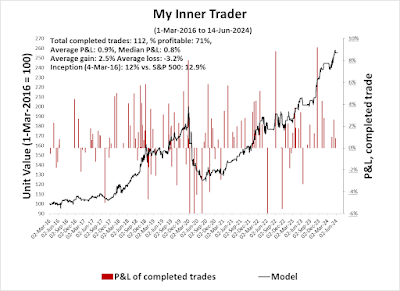

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

* The performance chart and model readings have been delayed by a week out of respect to our paying subscribers.Update schedule: I generally update model readings on my

site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown

here.

Subscribers can access the latest signal in real time

here.

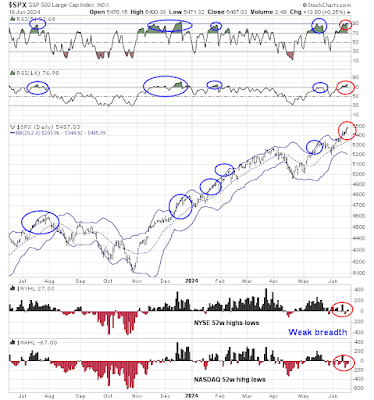

A failed breadth thrust?

Is the Triple 70 breadth thrust that triggered on May 6 in trouble? As a reminder, a Triple 70 breadth thrust occurs when the percentage of NYSE advances exceed 70% for three consecutive days, which is a bullish momentum signal. If history is any guide,

Rob Hanna’s study of such events has seen strong bullish momentum follow through.

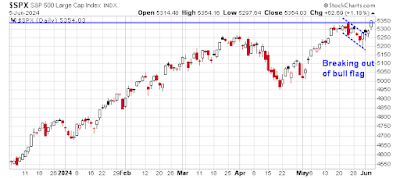

On the other hand, the short-term warning signs have been appearing everywhere. Even as the S&P 500 advanced to new all-time highs, the 5-week RSI flashed a negative divergence, and so did the VVIX/VIX ratio.

Is this evidence of a failed breadth thrust? How should investors react to the simultaneous appearance of bullish price momentum signals like a breadth thrust and the risk of dips from negative technical divergences?

The full post can be found here.