The full post can be found here.

Wednesday, July 30, 2025

A Matter of Expectations

Saturday, July 26, 2025

Fresh Highs = Bullish Tape

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “bearish” on 27-Jun-2025)*

- Trading model: Bullish (Last changed from “neutral” on 10-Jul-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Bullish Breakout

It is said that there is nothing more bullish than an all-time high. The S&P 500 achieved that feat last week when it staged an upside breakout to a fresh high after making a panic V-shaped bottom in April. The 14-week RSI is not overbought, indicating further potential upside. The equal-weighted S&P 500 also made a marginal closing high for the week.While I see some nervousness among traders, there is no denying that this is a bull market. Don’t fight the tape.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Tariffs: Bark Worse Than Bite?

Wednesday, July 23, 2025

A (Tentative) Upside Breakout

The full post can be found here.

Sunday, July 20, 2025

The Dog that Didn't Bark

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “bearish” on 27-Jun-2025)*

- Trading model: Bullish (Last changed from “neutral” on 10-Jul-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Speculative Buying Stampede

The signature moment in the Sherlock Holmes tale, “The Adventure of Silver Blaze”, was the dog that didn’t bark. Holmes deduced that a guard dog didn’t bark because he was approached by someone he knew. Similarly, the latest seemingly frothy advance is showing few signs of speculative excess, indicating further upside potential.

The full post can be found here.

Saturday, July 19, 2025

The Trade War is dead! Long Live the Trade War!

That’s because despite all of the dire headlines about the imposition of a 25% tariff rate on Canada and 30% on Mexico and the European Union, the only trade war that matters is effectively over. China has won, and the stock market is rallying in relief.

Wednesday, July 16, 2025

A Resilient Stock Market

The full post can be found here.

Sunday, July 13, 2025

The Bullish Elephant in the Room

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “bearish” on 27-Jun-2025)*

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Bullish Tripwires

Two weeks ago, I outlined the bull case for stocks, which was characterized as having the odds of one in three or four (see Buy the Cannons: Exploring the Bull Case). At the time, I set out three bullish tripwires, all of which have been triggered.

The small-cap Russell 2000 was tracing out an inverse head and shoulders pattern and it was unclear at the time whether it would stage a breakout above the neckline. The Russell 2000 has decisively broken out.

My long-term timing model was on the verge of a buy signal based on the MACD crossover of the NYSE Composite from negative to positive. That signal was triggered and it has extensively discussed in these pages.

The final trigger was a broad improvement in breadth. The S&P 500 and the NYSE Advance-Decline lines had broken out to all-time highs, but net 52-week highs-lows hadn’t made a new 2025 high. Fast forward to today, that indicator (bottom panel) made a 2025 high last week, and the mid-cap S&P 400 A-D Line also broke out to a new high. The only shoe left to drop is the small-cap S&P 600 A-D Line, which is lagging and yet to make an all-time high. At this rate, that’s only a matter of time.

The full post can be found here.

Saturday, July 12, 2025

An Update on Gold: Time for a Pause?

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Wednesday, July 9, 2025

Tariff Man Returns

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Sunday, July 6, 2025

Should You Embrace the Melt-up?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “bearish” on 27-Jun-2025)*

- Trading model: Neutral (Last changed from “bullish” on 14-Apr-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

The Return of Irrational Exuberance

The bank noted that the measure, which is calculated from derivatives metrics, volatility technicals and sentiment signals inferred from options markets, has historically averaged around 7%, but occasionally it peaks above 10% as during the Dotcom era of the late 1990s, and the meme-stock frenzy of 2021. The gauge currently sits around 10.7%, data compiled by Barclays show.

At the moment, the S&P 500 is a little extended while grinding out new highs and it’s on an upper Bollinger Band ride. Should traders embrace or fade the melt-up?

Saturday, July 5, 2025

Can a New Bull Begin at a Forward P/E of 22?

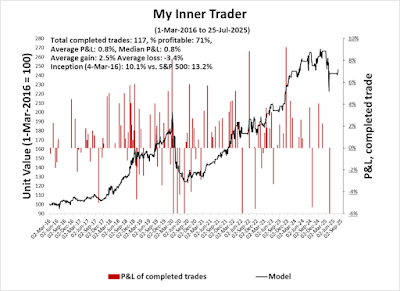

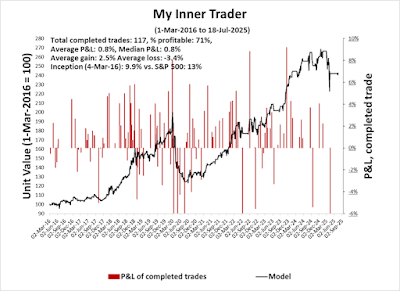

This model has shown a strong track record over the years. If you had sold in late January and bought back in when the S&P 500 made a new high last week, you would have missed the tariff drama drawdowns of the last few months.

In my discussions with investors, one key question keeps coming up. The S&P 500 is trading at a forward P/E of 22. Can a new bull truly begin at such elevated valuations?

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

Wednesday, July 2, 2025

Broadening Breadth?

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.