Preface: Explaining our market timing models

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

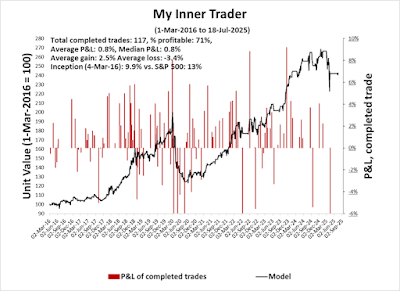

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “bearish” on 27-Jun-2025)*

- Trading model: Bullish (Last changed from “neutral” on 10-Jul-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Speculative Buying Stampede

You can tell a lot about the character of market psychology by the way it responds to news. In the past week, the stock market has faced the challenge of unexpected tariff levels of 30% on Mexico and the European Union, higher-than-expected levels of tariff pass-through in the CPI report and a Trump trial balloon to fire Fed Chair Powell for cause. In the end, the S&P 500 rose on the week.

The rally off the April bottom is characterized by a FOMO stampede of low-quality stocks. The accompanying chart illustrates the degree of speculation. Bitcoin has surged to an all-time high, and the relative performance of ARK Investment ETF (ARKK) rose sharply to a new recovery high. It all looks very frothy.

The signature moment in the Sherlock Holmes tale, “The Adventure of Silver Blaze”, was the dog that didn’t bark. Holmes deduced that a guard dog didn’t bark because he was approached by someone he knew. Similarly, the latest seemingly frothy advance is showing few signs of speculative excess, indicating further upside potential.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

No comments:

Post a Comment