Preface: Explaining our market timing models We maintain several market timing models, each with differing time horizons. The "

Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 11-Oct-2024)*

- Trading model: Bullish (Last changed from “neutral” on 15-Oct-2024)*

* The performance chart and model readings have been delayed by a week out of respect to our paying subscribers.Update schedule: I generally update model readings on my

site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown

here.

Subscribers can access the latest signal in real time

here.

A cloudy crystal ball

As a quantitative equity manager, I employed diversified and uncorrelated groups of factors to pick stocks, including technical analysis, earnings expectations, valuation, growth and growth at a reasonable price. During my tenure, different markets would experience external shocks, such as financial crises (Asian Crisis) and natural disasters (Fukushim). The quantitative factor response playbook would always follow the same script.

It begins with a price shock as everyone scrambles to assess the market implications. During this period, none of the stock picking factors worked because of the new information that isn’t reflected in the factors.

As the market begins to settle down, technical analysis factors would show alpha. This would be followed by estimate revision. That’s because company analysts don’t revise their earnings estimates until they can quantify the effects of the shock. This would be followed by the fundamental factors, such as value and growth. As an example, I flattened all my positions in an equity market-neutral portfolio in the wake of 9/11 as I knew I would only be trading on noise until there was greater clarity on fundamentals.

While the Trump victory doesn’t qualify as a disaster in the manner of Fukushima or 9/11, it does represent a discontinuous external shock to market expectations whose effects are difficult to quantify. While the direction of policy changes are known, the magnitude of their effects are difficult to estimate without knowing the exact details.

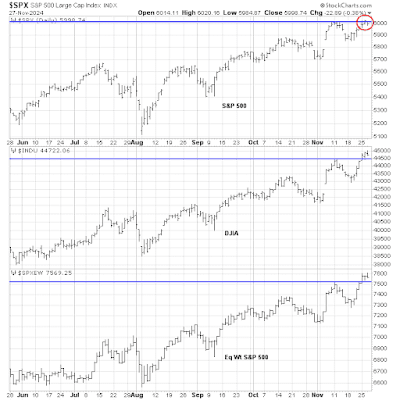

It is in that spirit I would assert the only guidance investors can rely on are market price signals, or technical analysis. That’s why it’s difficult to predict how the markets are likely to behave under the Trump Administration before he takes office.

My crystal ball is cloudy beyond a few weeks, but I can still take a look at the price response to the news.

The full post can be found

here.