Wednesday, July 31, 2024

Time to stick to technical analysis

Sunday, July 28, 2024

How to trade the Great Unwind

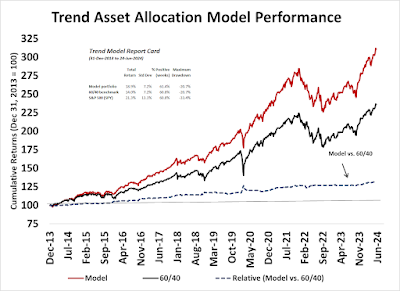

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Farrell’s Rule 2 in action

The risk unwind is also evident in the currency markets. The Japanese Yen strengthened against the USD, which is a sign of a carry trade unwind. The bottom panel shows the long Mexican Peso/short Japanese Yen carry trade of buying a high yielding currency while shorting the low yielding currency, which also reversed itself. What’s remarkable is the correlation the currency markets have shown to U.S. equity prices (top panel) and the equity factor of long NASDAQ and short small caps (bottom panel).

Saturday, July 27, 2024

China slowdown = Reduce risk

The full post can be found here.

Wednesday, July 24, 2024

4 reasons why you should buy the Great Rotation

The full post can be found here.

Sunday, July 21, 2024

Hey, hey, LBJ, how many kids have you killed today?

The one burning question of the Great Rotation

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Here come the Great Rotation

The full post can be found here.

Saturday, July 20, 2024

Positioning for Trump 2.0

In the wake of Biden’s subpar debate performance and the assassination attempt on Trump, the prediction markets’ odds of a Trump victory in November have substantially risen. Equally important is Wall Street’s reaction, which has investors sitting up to take notice of the implications of a second Trump Administration in 2025.

Despite the real-time information from the betting markets, financial markets haven’t fully discounted the possibility of a Trump win. Here’s how you can take advantage of that arbitrage opportunity.

Wednesday, July 17, 2024

How the small cap breakout could be short-term bearish

Saturday, July 13, 2024

A roadmap for the rest of 2024

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Another upper BB ride

The S&P 500 went on an upper Bollinger Band ride and unusually pulled back on Thursday after the soft CPI report and closed below the upper BB on Friday. What’s unusual is the risk-on tone adopted by the rest of the stock market even as heavyweight technology stocks in the S&P 500 weakened. The small-cap Russell 2000 gapped up and staged an upside breakout through a key resistance level in response to the prospect of lower interest rates owing to the weak CPI print.Historically, the S&P 500 has consolidated sideways for a few days after upper BB rides. Will this time be any different, or does small-cap strength foreshadow further price advances in the near future? What about the rest of 2024?

The full post can be found here.

Trading the slow market melt-up

The accompanying chart from Jurrien Timmer at Fidelity illustrates my point. If this is a bubble in the making, it could run a lot further as valuation differences are nowhere near the height of the Nifty Fifty or Dot-Com Bubble eras.

Wednesday, July 10, 2024

How I missed a trade (and what I would do)

The full post can be found here.

Sunday, July 7, 2024

Tops are processes

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Warnings everywhere

Even as the S&P 500 reached another all-time high, numerous warnings about a market top have been appearing in my social media feed and elsewhere, starting with the elevated level of the forward P/E ratio. The S&P 500 forward P/E now stands at 21.2, which is above its 5-year average of 19.3 and 10-year average of 17.9.

The full post can be found here.

Saturday, July 6, 2024

How politics is intruding on Fed policy

Recent U.S. economic data has generally been weakening, as evidenced by the decline in the Citigroup Economic Surprise Index (ESI, gold line), which measures whether economic data is beating or missing expectations. As ESI has been roughly correlated to bond yields, this should put downward pressure on rates and expectations of rate cuts in the near future.

Not so fast! Fed policy has become increasingly constrained by politics, both on a short- and long-term basis. Here’s why.