One of the main elements of my Trend Asset Allocation Model is commodity prices as a real-time indicator of global growth. As well, John Authers recently wrote, "The commodity market is a real-time attempt to assimilate geopolitical developments, growth fears, and shocks to supply and demand, so it’s an important place to look for the next few weeks." So far, commodities have been elevated even as the global economy showed signs of slowing. The divergence is attributable to supply shocks.

Despite the supply pressures, commodity prices have finally started to fall. In particular, the cyclically sensitive industrial metals have rolled over.

Here is what it all means.

The full post can be found here.

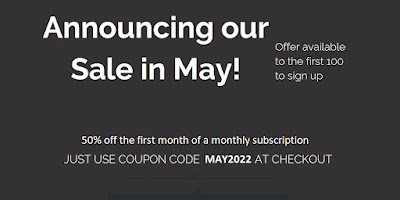

Sale in May

We would also like to announce our "Sale in May" event. Get 50% off a monthly subscription for the first month. Click here to subscribe.

No comments:

Post a Comment