Preface: Explaining our market timing models We maintain several market timing models, each with differing time horizons. The "

Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post,

Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The

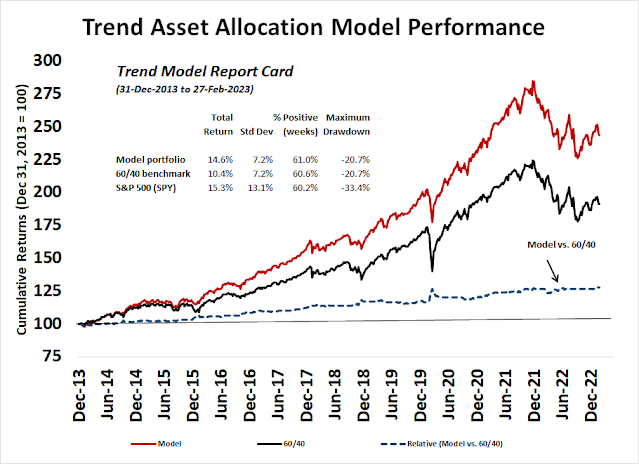

Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found

here.

My inner trader uses a

trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly

here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

* The performance chart and model readings have been delayed by a week out of respect to our paying subscribers.Update schedule: I generally update model readings on my

site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown

here.

Subscribers can access the latest signal in real time

here.

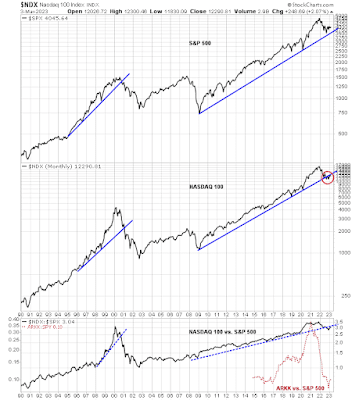

Breaks at key support

A week ago, I wrote that I was bullish on the equity outlook, but the S&P 500 appeared to be extended short-term and the Powell testimony and Jobs Report could be sources of volatility (see China:

Global bullish catalyst?). I was right on the volatility as Powell sounded a hawkish tone and the SVB crisis didn't help matters. The S&P 500 violated its key support levels at the 50 dma and 200 dma. In addition, the equal-weighted S&P 500, the mid-cap S&P 400, and the small-cap Russell 2000 all blew through the bottom of descending channels.

Is this the End? Here are the bull and bear cases.

The full post can be found

here.