The full post can be found here.

Monday, February 27, 2023

Is this the next FANG-style market darling?

Sunday, February 26, 2023

Decision time for bulls and bears

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

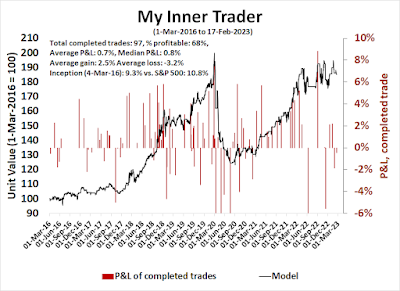

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

The full post can be found here.

Friday, February 24, 2023

Fight the tape, or the Fed?

The full post can be found here.

Wednesday, February 22, 2023

Oversold, but wait for the re-test

Sunday, February 19, 2023

Could EM weakness unravel the equity bull case?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Saturday, February 18, 2023

Is there an inflation threat in your future?

On Valentine's Day, the European Central Bank tweeted a poem to underscore its commitment to fighting inflation.

The ECB tweet is also indicative of the tight monetary policy undertaken by most major central banks. Only two central banks, the BoJ and the PBoC, are meaningful suppliers of global liquidity. The rest are raising interest rates and engaged in quantitative tightening. While the Fed may be on the verge of a pause, last week's hot PPI report and slightly stronger than expected CPI print has raised doubts about a dovish pivot.

Inflation is becoming a threat again.

The full post can be found here.

Wednesday, February 15, 2023

Sound the tactical all-clear

Mid-week market update: Last week, the usually reliable S&P 500 Intermediate Term Breadth Momentum Oscillator (ITBM) flashed a tactical sell signal when its 14-day RSI recycled from overbought to neutral.

It's time to sound the tactical all-clear in the aftermath of the sell signal.

The full post can be found here.

Sunday, February 12, 2023

Cautious signs of a bullish revival

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Saturday, February 11, 2023

Why you should fade the NASDAQ surge

The full post can be found here.

Wednesday, February 8, 2023

Making sense of the S&P 500 golden cross

Mid-week market update: In case you missed it, the S&P 500 experienced a "golden cross" this week, when the 50 dma rose above the 200 dma. This is generally regarded as a bullish development among the technical analysis crowd as an indication that the price trend has turned upward.

How should traders and investors interpret the golden cross signal?

The full post can be found here.

Monday, February 6, 2023

Was the January Jobs Report a data blip?

Sunday, February 5, 2023

Has the market reached escape velocity?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities*

- Trend Model signal: Bullish*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.