The full post can be found here.

Wednesday, July 24, 2024

4 reasons why you should buy the Great Rotation

Sunday, July 21, 2024

Hey, hey, LBJ, how many kids have you killed today?

The one burning question of the Great Rotation

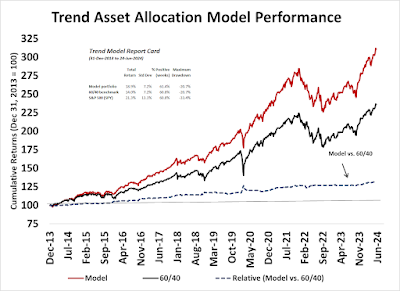

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Here come the Great Rotation

The full post can be found here.

Saturday, July 20, 2024

Positioning for Trump 2.0

In the wake of Biden’s subpar debate performance and the assassination attempt on Trump, the prediction markets’ odds of a Trump victory in November have substantially risen. Equally important is Wall Street’s reaction, which has investors sitting up to take notice of the implications of a second Trump Administration in 2025.

Despite the real-time information from the betting markets, financial markets haven’t fully discounted the possibility of a Trump win. Here’s how you can take advantage of that arbitrage opportunity.

Wednesday, July 17, 2024

How the small cap breakout could be short-term bearish

Saturday, July 13, 2024

A roadmap for the rest of 2024

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

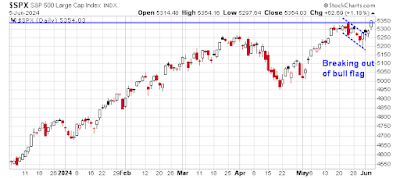

Another upper BB ride

The S&P 500 went on an upper Bollinger Band ride and unusually pulled back on Thursday after the soft CPI report and closed below the upper BB on Friday. What’s unusual is the risk-on tone adopted by the rest of the stock market even as heavyweight technology stocks in the S&P 500 weakened. The small-cap Russell 2000 gapped up and staged an upside breakout through a key resistance level in response to the prospect of lower interest rates owing to the weak CPI print.Historically, the S&P 500 has consolidated sideways for a few days after upper BB rides. Will this time be any different, or does small-cap strength foreshadow further price advances in the near future? What about the rest of 2024?

The full post can be found here.

Trading the slow market melt-up

The accompanying chart from Jurrien Timmer at Fidelity illustrates my point. If this is a bubble in the making, it could run a lot further as valuation differences are nowhere near the height of the Nifty Fifty or Dot-Com Bubble eras.

Wednesday, July 10, 2024

How I missed a trade (and what I would do)

The full post can be found here.

Sunday, July 7, 2024

Tops are processes

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Warnings everywhere

Even as the S&P 500 reached another all-time high, numerous warnings about a market top have been appearing in my social media feed and elsewhere, starting with the elevated level of the forward P/E ratio. The S&P 500 forward P/E now stands at 21.2, which is above its 5-year average of 19.3 and 10-year average of 17.9.

The full post can be found here.

Saturday, July 6, 2024

How politics is intruding on Fed policy

Recent U.S. economic data has generally been weakening, as evidenced by the decline in the Citigroup Economic Surprise Index (ESI, gold line), which measures whether economic data is beating or missing expectations. As ESI has been roughly correlated to bond yields, this should put downward pressure on rates and expectations of rate cuts in the near future.

Not so fast! Fed policy has become increasingly constrained by politics, both on a short- and long-term basis. Here’s why.

Wednesday, July 3, 2024

Positive seasonality boost the S&P 500

Sunday, June 30, 2024

How much is left in the bulls' gas tank?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Too far, too fast?

In light of these strong returns, how much gas is left in the bulls’ gas tank? Is this the case of the market going up too much, too fast?

Saturday, June 29, 2024

A Q2 earnings season preview

Wednesday, June 26, 2024

A market of NVIDIA and everything else

Sunday, June 23, 2024

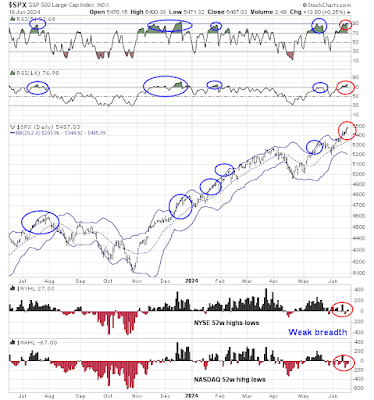

Why the breadth divergence may not be bearish

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A case of bad breadth

Even though these breadth divergences are concerning, they are not necessarily bearish signals. Here’s why.

Saturday, June 22, 2024

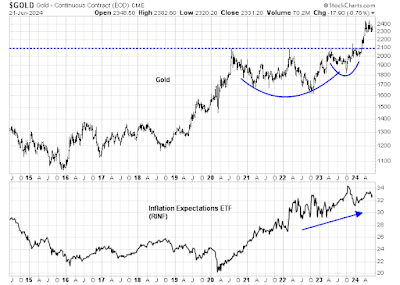

Why the November election matters to gold

I am reiterating my bullish outlook on gold. The yellow metal staged an upside breakout from a cup and handle pattern in March. As well, the long-term inflation expectations of ETF (RINF) has been in a steady uptrend. The only question is how far and how fast can gold run?

The future may be bright as gold prices respond to unexpected inflation. The non-partisan Congressional Budget Office (CBO) recently updated its projection of the U.S. fiscal path by raising its FY 2024 estimate of the deficit from $1.5 trillion to $1.9 trillion, driven by emergency spending on foreign assistance to Israel, Ukraine and Taiwan, as well as student loan relief. The long-term picture also deteriorated, the deficit rises to $2.8 trillion by 2034 and debt is expected to grow to 122% of GDP by 2034.

Wednesday, June 19, 2024

What's different this time

Sunday, June 16, 2024

Tactically cautious but not bearish

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Time for cheap protection?

Last week, I suggested that the stock market was susceptible to a setback (see A Time For Tactical Caution). Even though the pullback never appeared, I reiterate my cautious view, though I am not outright bearish.In light of the market’s vulnerable position, it may be time to exploit the low VIX and buy some cheap downside protection in the form of protective put options. The S&P 500 achieved a fresh all-time high while exhibiting a negative 5-week RSI divergence. As well, the VVIX/VIX ratio is showing a negative divergence. Such episodes have tended to resolve bearishly in the past. As well, the VIX Index is low and testing its lower boundary at 12, indicating low option premium and cheap cost of downside protection.

Saturday, June 15, 2024

The market gods present patient investors with three gifts

Remember that equity investors tend to enjoy strong returns in the absence of recession, which dents returns, or war and revolution, which can result in a permanent loss of capital. With those caveats in mind, the market gods are presenting patient investors with three gifts from the three economic blocs in the world: the U.S., Europe, and China.

The full post can be found here.

Wednesday, June 12, 2024

The market is fighting the Fed, should you?

Sunday, June 9, 2024

A time for tactical caution

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

The bull isn’t done

Make no mistake, I am intermediate-term bullish on U.S. equities. The monthly MACD buy signal remains in force and there are no signs of any negative divergence that signals a major market top.

Beneath the hood, however, disturbing signs of that not all is well in the short run. Here are bull and bear cases.

Saturday, June 8, 2024

Is good news good news, or bad news?

Is good economic news good news for equities or bad news? We know how to interpret macro news for the bond market. The Citi Economic Surprise Index (ESI), which measures whether top-down economic releases are beating or missing expectations, has been a bit weak. Historically, a weak ESI has meant lower bond yields.

What does it mean for equities? Investors saw a string of weaker-than-expected macro prints last week, starting with an anemic ISM PMI on Monday, followed by a miss on job openings in JOLTS Tuesday and another miss on ADP employment Wednesday. In each of those cases, bond prices rallied and equities initially weakened, followed by price recoveries later in the day.

I interpret events from the perspective of three trading desks: bonds, commodities and equities.

The full post can be found here.

Wednesday, June 5, 2024

A well-telegraphed market advance

Sunday, June 2, 2024

The market's dance of thrusts and dips

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Neutral (Last changed from “bullish” on 23-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A failed breadth thrust?

On the other hand, the short-term warning signs have been appearing everywhere. Even as the S&P 500 advanced to new all-time highs, the 5-week RSI flashed a negative divergence, and so did the VVIX/VIX ratio.

Is this evidence of a failed breadth thrust? How should investors react to the simultaneous appearance of bullish price momentum signals like a breadth thrust and the risk of dips from negative technical divergences?

The full post can be found here.

Saturday, June 1, 2024

Transitory disinflation in 2025?

The closely watched April PCE moderated as expected. Headline PCE came in 0.3%, in line with expectations, while core PCE was 0.2% (blue bars), which was softer than expectations. Supercore PCE, or services ex-energy and housing, also decelerated (red bars). This latest print represents useful progress, but won’t significantly move the needle on Fed policy.

The worrisome development is the global trend of transitory disinflation. The Citi Inflation Surprise Index, which measures whether incoming inflation data is beating or missing expectations, is bottoming in most countries and rising again. If this continues, any expectations of ongoing rate cuts are likely to be pulled back.

Now that 2024 is nearly half over, it’s time to peer into 2025 to see the upside and downside factors that are expected to affect inflation and the Fed’s interest rate trajectory. The three main factors to consider are changes in immigration policy and how they affect employment; the evolution in productivity; and the possible political effects of the election on inflation.

The full post can be found here.

Wednesday, May 29, 2024

A modest correction ahead?

Sunday, May 26, 2024

How to spot a market top

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

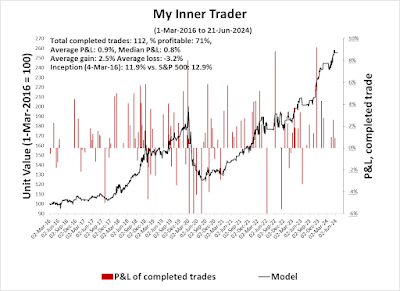

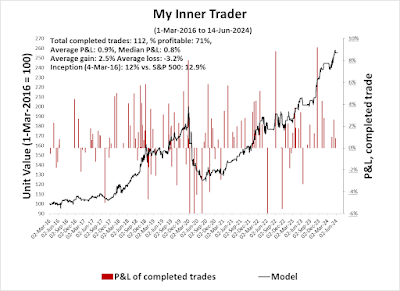

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Bullish (Last changed from “neutral” on 10-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Bearish Capitulation

Morgan Stanley’s strategist Mike Wilson has been one of the more prominent bears left standing and he capitulated last week. Now that Wilson has reluctantly turned bullish, is it time to turn contrarian bearish on stocks?I can think of two scenarios for the U.S. equity market. The bulls will argue that the market structure of the S&P 500 shows the index has outrun the bullish channel, as defined by the solid lines, and ascended to a steeper channel, as defined by the dotted lines. The advance has been characterized by a series of “good overbought” RSI signals. The bullish scenario opens up a short-term objective of 5500 before the rally is done.

The bears will argue that the combination of the “buy the rumour, sell the news” market reaction to the strong NVIDIA report and the negative divergence on the 5-week RSI is a signal of an exhaustive advance.

Saturday, May 25, 2024

How to buy a company with no money

The Wall Street equivalent of buying a company with no money down is the leveraged buyout, or LBO. The LBO was made possible by the popularization of junk bond, or high yield bond, financings, which was a financial innovation from the 1980s.

It turns out that LBO candidates are relatively rare. They may be the modern deep value equivalent of Ben Graham’s formulation of stocks trading below net-net working capital or current assets minus all debt.

Wednesday, May 22, 2024

Drifting and waiting for the NVIDIA report

Sunday, May 19, 2024

A Trend Asset Allocation Model review

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Bullish (Last changed from “neutral” on 28-Jul-2023)*

- Trading model: Bullish (Last changed from “neutral” on 10-May-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A Trend Model review

This week I review the model’s internals to reveal why I am bullish on equities.

The full post can be found here.