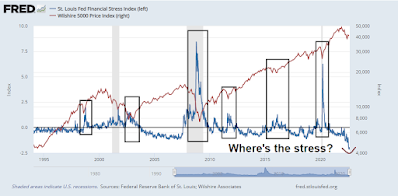

In Fed Chair Powell's speech, he underlined that tight monetary policy will “bring some pain to households and businesses” but vowed to “keep at it until the job is done”, which was a signal that there will be no dovish pivot until inflation is beaten. The only exception to that rule is a financial crisis. Historically, equity markets haven't bottomed until the St. Louis Fed Financial Stress Index has risen to positive. While the index has begun to turn up from a very low level, stress levels are still very tame, indicating that financial crisis risk is still relatively low.

The full post can be found here.

No comments:

Post a Comment