Fed Chair Jerome Powell made it clear at the post-FOMC press conference. The Federal Reserve is nowhere close to ending its campaign of rate increases. While last two CPI reports show "a welcome reduction in the monthly pace of price increases...It will take substantially more evidence to have confidence that inflation is on a sustained downward path."

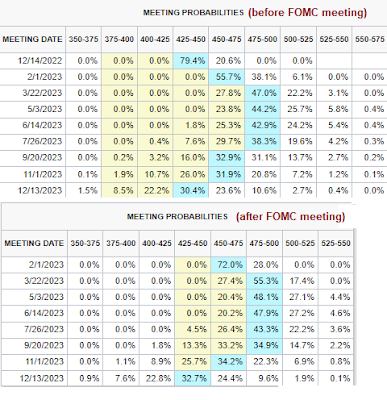

Moreover, the "dot plot" showed a median Fed Funds rate of 5.1%, which is above market expectations. In the aftermath of the FOMC meeting and press conference, Fed Funds expectations barely budged. The terminal rate stayed the same at just under 5%, though the expected path of rate cuts was pushed out by a month from the September to the November meeting.

Wall Street is fighting the Fed. Should you join in? Here are the bull and bear cases.

The full post can be found

here.

No comments:

Post a Comment