We maintain several market timing models, each with differing time horizons. The "Ultimate Market Timing Model" is a long-term market timing model based on the research outlined in our post, Building the ultimate market timing model. This model tends to generate only a handful of signals each decade.

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

My inner trader uses a trading model, which is a blend of price momentum (is the Trend Model becoming more bullish, or bearish?) and overbought/oversold extremes (don't buy if the trend is overbought, and vice versa). Subscribers receive real-time alerts of model changes, and a hypothetical trading record of the email alerts is updated weekly here. The hypothetical trading record of the trading model of the real-time alerts that began in March 2016 is shown below.

The latest signals of each model are as follows:

- Ultimate market timing model: Sell equities*

- Trend Model signal: Neutral*

- Trading model: Neutral*

Update schedule: I generally update model readings on my site on weekends. I am also on Twitter at @humblestudent and on Mastodon at @humblestudent@toot.community. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Some hope for the future

Every market cycle is different, but all bear markets share some common elements, namely that asset prices fall. 2022 was unusual inasmuch as both stock and safe haven Treasury prices fell together. Nevertheless, there is some hope for the future.

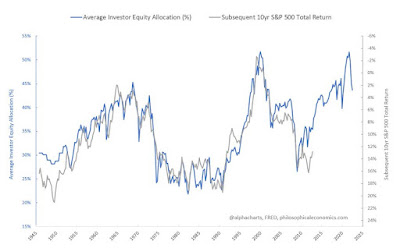

Nine years ago, Jesse Livermore found that forward 10-year equity returns were inversely correlated to household equity positioning. The equity bear market has sent household equity exposure skidding. I would further argue that the normalized position is actually lower. Normally, bond prices rise during equity bear markets, which raise bond allocations and depress stock allocations. When stock and bond prices fell in tandem in 2022, the diversification effect was lost. Household equity allocations should have been lower in a "normal" bear market (see The hidden story of investor capitulation).

As investors bid goodbye to 2022, here is how my models performed during a difficult year.

The full post can be found here.

No comments:

Post a Comment