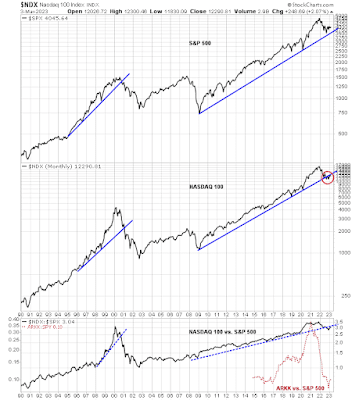

It was the best of times. It was the worst of times. The S&P 500 (SPX) remains in a well-defined uptrend, but the NASDAQ 100 (NDX), which represents large-cap growth, violated an uptrend that stretches back to the GFC. The relative performance of the NASDAQ 100 to the S&P 500 shows a similar trend break that’s somewhat reminiscent of the Tech Bubble top of 2000. Moreover, the recent relative performance of speculative growth stocks, as measured by ARK Investment ETF (ARKK), is similar to the post-2000 Bubble bust.

The full post can be found here.

No comments:

Post a Comment