As expected, the Federal Reserve left interest rates unchanged. The Fed Chair acknowledged a high degree of uncertainty about the effects of tariffs: “Ultimately the cost of the tariff has to be paid, and some of it will fall on the end consumer. We know that’s coming, and we just want to see a little bit of that before we make judgments prematurely.”

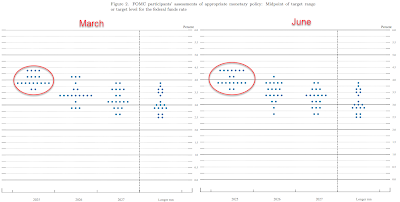

The “dot plot” took a surprising hawkish turn. Seven FOMC members expect no rate cuts in 2025, compared to four in March, and two expect a single quarter-point cut, compared to four in June. But the hawkish pivot occurred against a backdrop of uncertainty as Powell admitted that the projected policy path is only a guess. The Fed’s forecast of inflation and growth has become clouded in the face of the unknown effects of tariffs: “We haven’t been through a situation like this, and I think we have to be humble about our ability to forecast it.”

It is not surprising that Fed policy makers have adopted a wait-and-see attitude as they watch for clues from the hard economic data.

The full post can be found here.

Special announcement: Humble Student of the Markets will cease publication on March 31, 2026. See this announcement for more details and updates.

No comments:

Post a Comment