Mid-week market update: The stock market surged last week in reaction to the soft CPI reading. It got better news this week when PPI came in lower than expected. As well, China unveiled a 16-point package to try and stabilize its cratering property market and softened some of its Zero COVID policies. Berkshire Hathaway unveiled a new long position in TSMC, which light a fire under semiconductor stocks, though Micron's warning this morning unwound some of the rally.

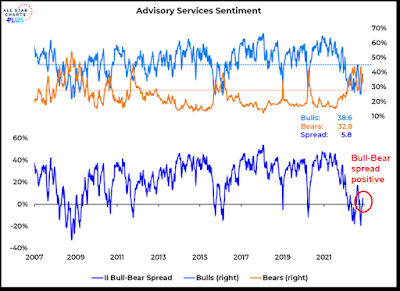

As a consequence, the Investors Intelligence survey showed that the bull-bear spread turned positive. Increasingly, I am seeing discussions about positioning for a year-end rally.

Should you jump on the year-end rally bandwagon?

The full post can be found

here.

No comments:

Post a Comment