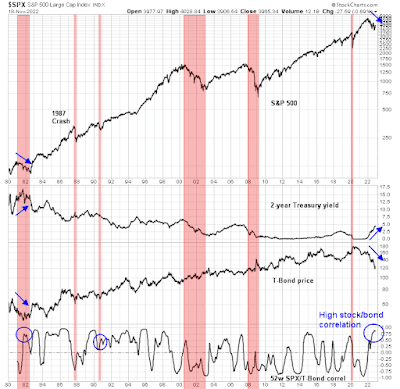

Not so in 2022. You would have to go back to the double-dip recession of 1980-1982 to see a prolonged period of positive correlation between stock and bond prices. That era was characterized by the hawkish Volcker Fed, which was determined to keep raising rates in order to squeeze inflationary expectations out of the economy. Fast forward to 2022, the Powell Fed appears to be on a similar path. What does that mean for investors?

Here are the challenges for stock, bond and balanced fund investors as we peer into 2023.

The full post can be found here.

No comments:

Post a Comment