Wednesday, January 29, 2025

Waiting for the gaps to fill

Sunday, January 26, 2025

Tips on navigating the post-inauguration rally

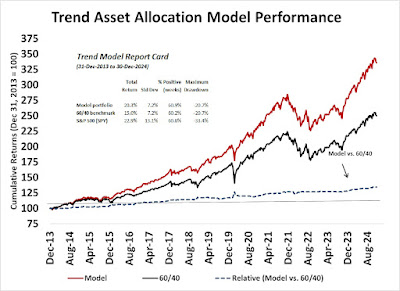

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Neutral (Last changed from “bullish” on 17-Jan-2025)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Time for a pause?

January is almost over, and the S&P 500 staged an upside breakout to an all-time high last week, which Jeffrey Hirsch found is consistent with market seasonality. If the seasonal patterns found by Almanac Trader were to continue, stock prices are likely to be flat to down in February.

The full post can be found here.

Saturday, January 25, 2025

Two key risks to the bull that no one is talking about

The S&P 500 has been in a steady uptrend for over two years and it just staged an upside breakout to an all-time high. It may seem counterintuitive to be discussing the risks of a major market top, but I am seeing some early warnings that few analysts are paying attention to.

The full post can be found here.

Wednesday, January 22, 2025

The Trump Put lives!

Sunday, January 19, 2025

What a changing of the guard means for stocks

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 19-Dec-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

A bond market reversal

Last week, we highlighted the risk-off tone caused by the bond market tantrum that was under way. As the week progress, softer-than-expected PPI and CPI reports calmed the bond market vigilantes and yields retreated.

The reversal occurred just in time for the changing of the guard at the White House.

Saturday, January 18, 2025

Trump 2025 market = Reagan 1981?

The S&P 500 topped out for the market cycle in late November just after Reagan won the election, though the Dow, which was the more widely quoted market index of the day, made a second high in April 1981. The NYSE Advance-Decline Line topped out in September 1980 and telegraphed the market’s technical deterioration.

There are many eerie similarities. Today’s stock market is struggling to regain its highs after a rally after Trump’s electoral win. The Advance-Decline Lines are also weak and technical analysts have expressed concerns about negative breadth divergences. The key difference is the Volcker Fed raised interest rates to punishingly high levels during Reagan’s era, while today’s Fed is pursuing a policy of monetary easing. The 2-year Treasury rate, which is a proxy for Fed Funds expectations, rose steadily and didn’t top out until August 1981.

Wednesday, January 15, 2025

What an actual bond market catastrophe looks like

Monday, January 13, 2025

A focus on financials

The full post can be found here.

Sunday, January 12, 2025

What's rattling the stock market?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 19-Dec-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Is the honeymoon over?

Four weeks ago, I published an article entitled “The Public Embraces the Trump Honeymoon”. Under ordinary circumstances, a relief rally should be well underway by now. Is the honeymoon over? How patient should investors be with the bull case?

The full post can be found here.

Saturday, January 11, 2025

A preview of the Sino-American Trade War 2.0

In the face of economic weakness, China seems to be preparing for Trade War 2.0 on a different dimension of belligerence. China has embraced von Clausewitz’s famous quote on war: “War is merely the continuation of politics by other means.”

Investors should prepare for greater newsflow volatility and rising geopolitical risk in the months ahead.

The full post can be found here.

Wednesday, January 8, 2025

A tale of two markets

- The S&P 500 and Russell 2000 had to stage upside breakout through the falling dotted trend line. While the S&P 500 briefly broke out, it retreated yesterday through the trend line. The Russell 2000 never came close to a breakout.

- The S&P 500 and Russell 2000 had to break out of their sideways range. Not yet.

- Small caps should outperform, indicating broadening breadth and better participation in an advance. The bad news is the small cap Russell 2000 is lagging. The good news is the equal-weighted S&P 500 is holding up well on a relative basis, and small caps outperformed yesterday during the market decline.

Sunday, January 5, 2025

A failed Santa rally, now what?

The Trend Asset Allocation Model is an asset allocation model that applies trend-following principles based on the inputs of global stock and commodity prices. This model has a shorter time horizon and tends to turn over about 4-6 times a year. The performance and full details of a model portfolio based on the out-of-sample signals of the Trend Model can be found here.

- Ultimate market timing model: Buy equities (Last changed from “sell” on 28-Jul-2023)*

- Trend Model signal: Neutral (Last changed from “bullish” on 15-Nov-2024)*

- Trading model: Bullish (Last changed from “neutral” on 19-Dec-2024)*

Update schedule: I generally update model readings on my site on weekends. I am also on X/Twitter at @humblestudent and on BlueSky at @humblestudent.bsky.social. Subscribers receive real-time alerts of trading model changes, and a hypothetical trading record of those email alerts is shown here.

Subscribers can access the latest signal in real time here.

Santa has left for the year…

As I pointed out last week, the Santa Claus rally window is the last four days of the year and the first two days of the new year, and it’s one of the seasonally bullish periods of the year. History shows that a failed Santa rally often leads to subpar returns for the remainder of the year. The first day of the window was December 24 and the last day was January 3.Santa has failed to call this year. The S&P 500 and the Dow closed above their respective Santa rally levels, though the Russell 2000 was marginally positive.

If adage about the Santa Claus rally is to be believed, the odds favour a subpar year in 2025 for the S&P 500: “If Santa should fail to call, the bears may come to Broad and Wall”.

Saturday, January 4, 2025

Trump's messy governing challenges

According to FactSet, the bottom-up aggregated S&P 500 target price for year-end 2025 is 6,678.18. But in the last 20 years, bottom-up analysts have historically overestimated the S&P 500 year-end price by 6.9%. Applying the 6.9% discount we would arrive at an adjusted target of 6,084.19, which represents a price gain of 5.7% for the year.

The FactSet adjusted estimate is roughly in line with my expectation of low single-digit gains. Along the way, however, I expect a higher degree of market volatility during the year as the Trump 2.0 Administration takes office and faces the challenges of governing.

Wednesday, January 1, 2025

So much for December seasonality

Instead, the stock market was weak in the second half of December and small caps leadership did not emerge during that period. That said, the S&P 500 ended to year right at trend line support and the NASDAQ 100 ended the year at 50 dma support.